Barista FIRE: Unlocking Financial Freedom through Geo-Arbitrage and a Flexible Lifestyle

Please note: This post may contain affiliate links. See our disclosure to learn more.

Remote Jobs > Online Businesses > Barista FIRE: Unlocking Financial Freedom through Geo-Arbitrage and a Flexible Lifestyle

Discover how the Barista FIRE strategy can help you achieve financial freedom through smart investing, reduced living expenses, and embracing a lifestyle of travel and flexibility.

Have you ever dreamed of achieving financial freedom and having the flexibility to live life on your own terms? The concept of Barista FIRE might be the key to unlocking that dream. Whether you're new to investing or unfamiliar with the FIRE movement (Financial Independence, Retire Early), this guide will introduce you to the strategies that can help you reduce your living expenses, grow your wealth, and even travel the world—all while maintaining a fulfilling lifestyle.

In this article, we'll explore:

What the FIRE movement is and how it works

The basics of investing and generating residual income

The Barista FIRE approach and how it differs from traditional FIRE

How geo-arbitrage can significantly reduce your living expenses

Practical steps to start your journey toward financial independence

Let's dive in!

Table of Contents

Basics of Investing for Beginners

How Investments Work

Investing is the act of allocating money into assets like stocks, bonds, or real estate with the expectation of generating income or profit over time. Here's how it helps you:

Compound Growth: Your investments can earn returns, and those returns can earn returns themselves.

Residual Income: Investments can provide ongoing income through dividends, interest, or rental income.

Wealth Building: Over time, investments can significantly increase your net worth.

Simple Investment Strategies

Start Early: The sooner you start investing, the more time your money has to grow.

Diversify: Spread your investments across different assets to reduce risk.

Keep Costs Low: Minimize fees and expenses that can eat into your returns.

Stay Consistent: Regularly contribute to your investments, regardless of market conditions.

Here’s an Example

When you invest your money, your money will be working for you and typically earns you 6-12% per year of additional money. How much money is that exactly? Well, it depends on how much you have to invest, of course.

So, for the sake of making things easy to understand, essentially every $10,000 that you invest into the market will earn you an additional income of $600 to $1,200 every single year (on average). [Learn how we travel the world on only $1,000 per month!]

At some point the “extra income” might even be enough to completely replace your regular income!

But, wouldn’t it take an extremely long time to accumulate that much money?

Typically, yes. However, there is a new method called “FIRE” that can get you to retirement in as little as 10 years! I know that might sound magical, but it really can work that quickly if you simply follow the directions.

After learning how to automate this “FIRE” process, I’ll recommend a few other methods that you can apply to your investments that can get you there a even faster.

That’s right, methods that I’ve learned over the years - as an Investment Manager and Financial Advisor - that you can combine with the lessons in FIRE and get you from having $0.00 in your bank account today to complete Financial Independence and Retirement in as little as 5 years!

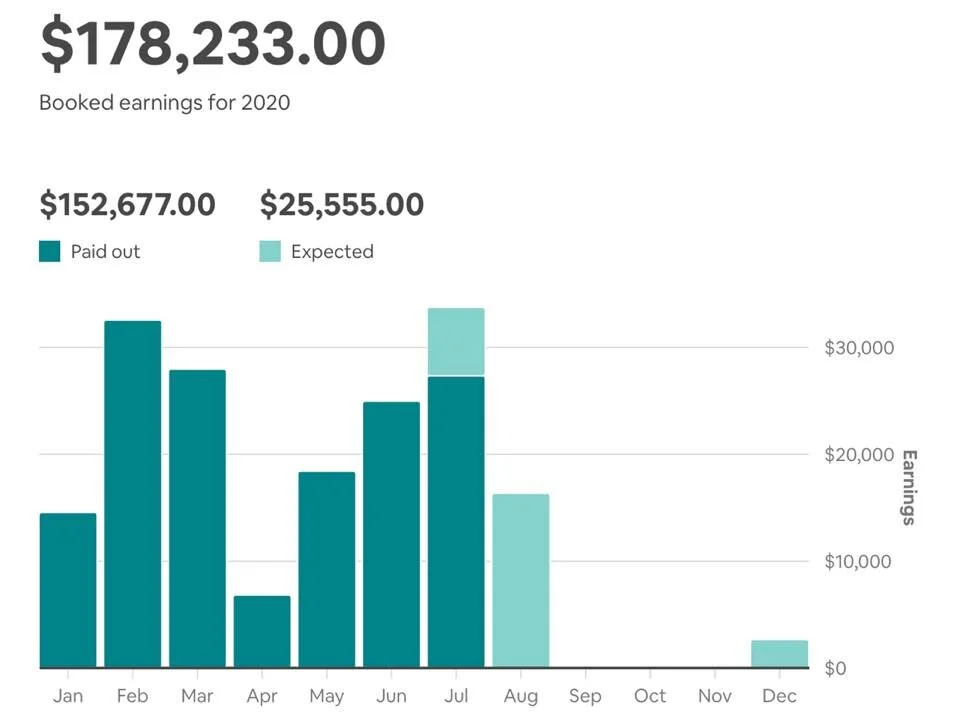

My Barista FIRE Story

Every digital nomad has their own story about how they “broke free” from the rat race and what keeps them going. My story is about how I used investments to create a residual income and how that income pays me enough each month to allow us to travel forever.

“Wealth, like a tree, grows from a tiny seed. The first copper you save is the seed from which your tree of wealth shall grow. The sooner you plant that seed the sooner shall the tree grow. And the more faithfully you nourish and water that tree with consistent savings, the sooner may you bask in contentment beneath its shade.”

― George S. Clason, The Richest Man in Babylon

I learned about this in a number of ways, but the short story that really stuck with me comes from the book “The Richest Man in Babylon”.

The lessons from this book still work today - and although I have a substantial background in Finance and Investments:

Bachelors and Masters Degrees focused on Finance and Financial Engineering

Years of experience as a Personal Financial Advisor, Investment Manager, and Corporate Financial Analyst

I honestly believe that you don’t need that experience to apply the simple knowledge learned in that book.

However, to help add a little more value, I’m going to share with you the most important lessons that I’ve learned since I got started back in 2008 to help you get to retirement much quicker than you might be thinking.

Understanding the FIRE Movement

What is the FIRE Movement?

The FIRE movement, which stands for Financial Independence, Retire Early, is a lifestyle and financial strategy that encourages people to save and invest a large portion of their income to achieve financial independence at a younger age than traditional retirement plans allow.

Key Principles of FIRE

High Savings Rate: Saving 50% or more of your income.

Frugal Living: Reducing unnecessary expenses to maximize savings.

Investing Wisely: Putting your savings into investments that grow over time.

Passive Income Generation: Building income streams that don't require active work.

Why Pursue FIRE?

Financial Freedom: No longer being dependent on a paycheck.

Lifestyle Flexibility: Having the freedom to choose how you spend your time.

Early Retirement: The ability to retire decades earlier than the traditional age.

You can learn a bit more about it on our FIRE Community page.

What is Barista FIRE?

Defining Barista FIRE

Barista FIRE is a variation of the traditional FIRE strategy. Instead of completely retiring from work, individuals pursuing Barista FIRE aim to achieve financial independence that allows them to work part-time or in lower-stress jobs—like a barista! This approach reduces the total amount of savings needed and can make early retirement more attainable.

How Barista FIRE Works

Partial Financial Independence: Accumulate enough investments to cover a significant portion, but not all, of your living expenses.

Supplemental Income: Work part-time or pursue passion projects to cover the remaining expenses.

Benefits of Part-Time Work:

Access to healthcare benefits.

Social interaction and personal fulfillment.

Additional income to reduce withdrawal from investments.

Advantages of Barista FIRE

Lower Savings Target: Requires less savings compared to traditional FIRE.

Work-Life Balance: Combines financial freedom with meaningful work.

Flexibility: Allows for travel, hobbies, and spending more time with family.

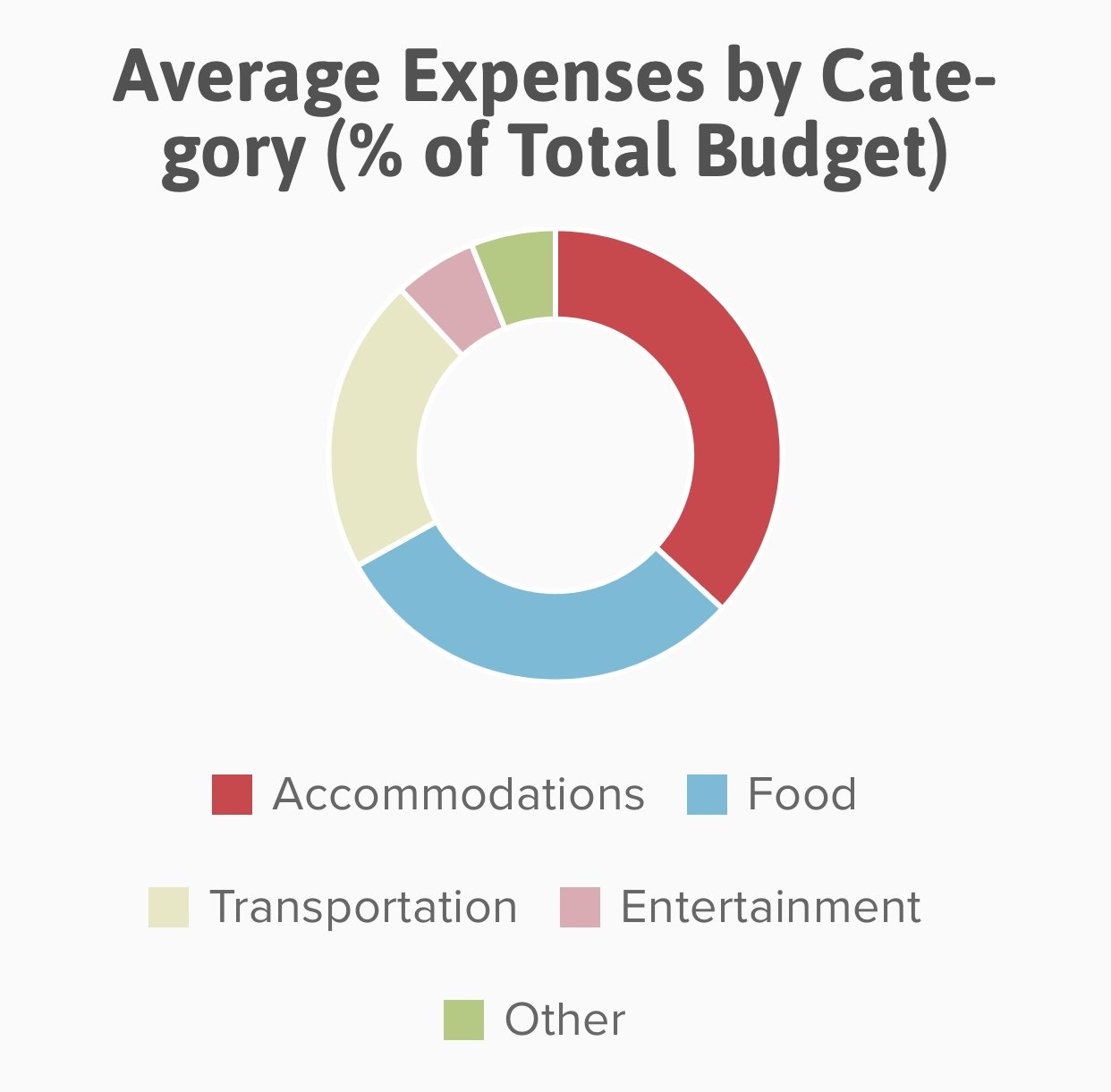

Leveraging Geo-Arbitrage to Reduce Living Expenses

What is Geo-Arbitrage?

Geo-arbitrage involves taking advantage of the cost-of-living differences between locations. By living in areas where expenses are lower, your money goes further, accelerating your path to financial independence.

If you really want to, or even you have to, you can commit to traveling between a couple of countries - or even retiring in a foreign country - instead, some of which only require 25 percent of what you think you need to retire (yes, where everything is basically 75% cheaper every single day)! There are MANY countries in the world where the cost of living is cheaper, but the quality of life is actually higher!

How Geo-Arbitrage Enhances Barista FIRE

Cost Savings: Lower housing, food, and transportation costs reduce the amount you need to earn.

Increased Savings Rate: More of your income can be invested.

Cultural Experiences: Opportunity to live and travel in different parts of the world.

Examples of Geo-Arbitrage

Domestic: Moving from a high-cost city to a more affordable one within your country.

International: Living abroad in countries with a lower cost of living while earning income remotely or from investments.

We take advantage of this method frequently while traveling around the world.

If you check out our budget over the first 5 years of traveling the world, you’ll see that we learned how to keep our expenses fairly low - less than $1,000 per month per adult in many years - and we’re happy to teach you how to do that as well. In fact, we have some great resources for that:

Key Lessons from FIRE

Key Lesson 1: Lower Investment Fees

One big draw to FIRE is the fact that fees tend to eat up investment returns, so FIRE advises you to find the lowest possible fees that you can.

For example, if you’re earning an 8% return on your money each year but the fees are 2%, then you only end up keeping 6% each year.

That is actually 25% of your income in year 1 alone, but it can compound to be a massive amount over a 10-20 year period.

Your investments could have had more than DOUBLE the money at the end of year 40 if you simply had a 0.1% fee instead of a 2.0% fee.

That 2% fee cuts away 40% of your profits over a 20 year period, and over 52% of your profits over 40 years - simply due to the decrease in compound growth year-over-year.

Too many investment advisors are getting paid this fee just to allocate money into different mutual funds for you. Learning how to do that on your own is VERY simple - a single FIRE based book can teach you how to do it - so it’s not worth paying half of your retirement for that knowledge!

“There are far, far more people on Wall Street who made their money through their selling ability than through their investing ability.” - Warren Buffett

So, like the quote above by Warren Buffett says, nearly all of these advisors are getting rich simply by bringing on new clients and charging them fees - and not in any way by their skill of selecting “winners,” or good investment opportunities. That is a completely different topic, which I will discuss with you later when we attempt to speed up your retirement date. As for nearly all the advisors out there, they are just there to allocate you into these funds and get paid the fee.

I, and a few other financial advisors that I know, found that charging these annual percentage fees was NOT in the best interest of the client and, therefore, feel that it is unethical. Knowing that, we’ve all changed careers. I started managing investments instead, where the efforts that I made actually added value instead of taking it away.

The book A Random Walk Down Wall Street, concludes that owning a broad based index fund of most stocks will do better than having an active portfolio manager over the long term. This isn’t wrong, as most financial advisors simply don’t do anything more for you than place you into these funds and then keep getting paid, on your money, every single year thereafter!

This fact has been proven, by and far, in nearly every situation that an independent investor could participate in - to the point that it would be like winning the lottery with an active manager to beat it. It's just not worth trying, and it costs way too much money in the long run with the fees.

And the main reason the index funds do better than having an active financial advisor? Most index funds have extremely low fees. It really is that simple.

Key Lesson 2: Save More

Another key takeaway from the FIRE community is that, to really maximize your potential here, you should be saving “far more than the standard 10–15% typically recommended by financial planners.”

By using the FIRE method, some people have learned how to save up to 75% of their income per year. It teaches you how to be more frugal and how to get more with less. In other words, you may not need to give up anything in order to save more.

Combined with their methods of investing into high-return index funds with extremely low fees, they are able to create an investment that is large enough to completely replace their incomes.

“At a 75% savings rate, it would take less than 10 years of work to accumulate 25 times the average annual living expenses.”

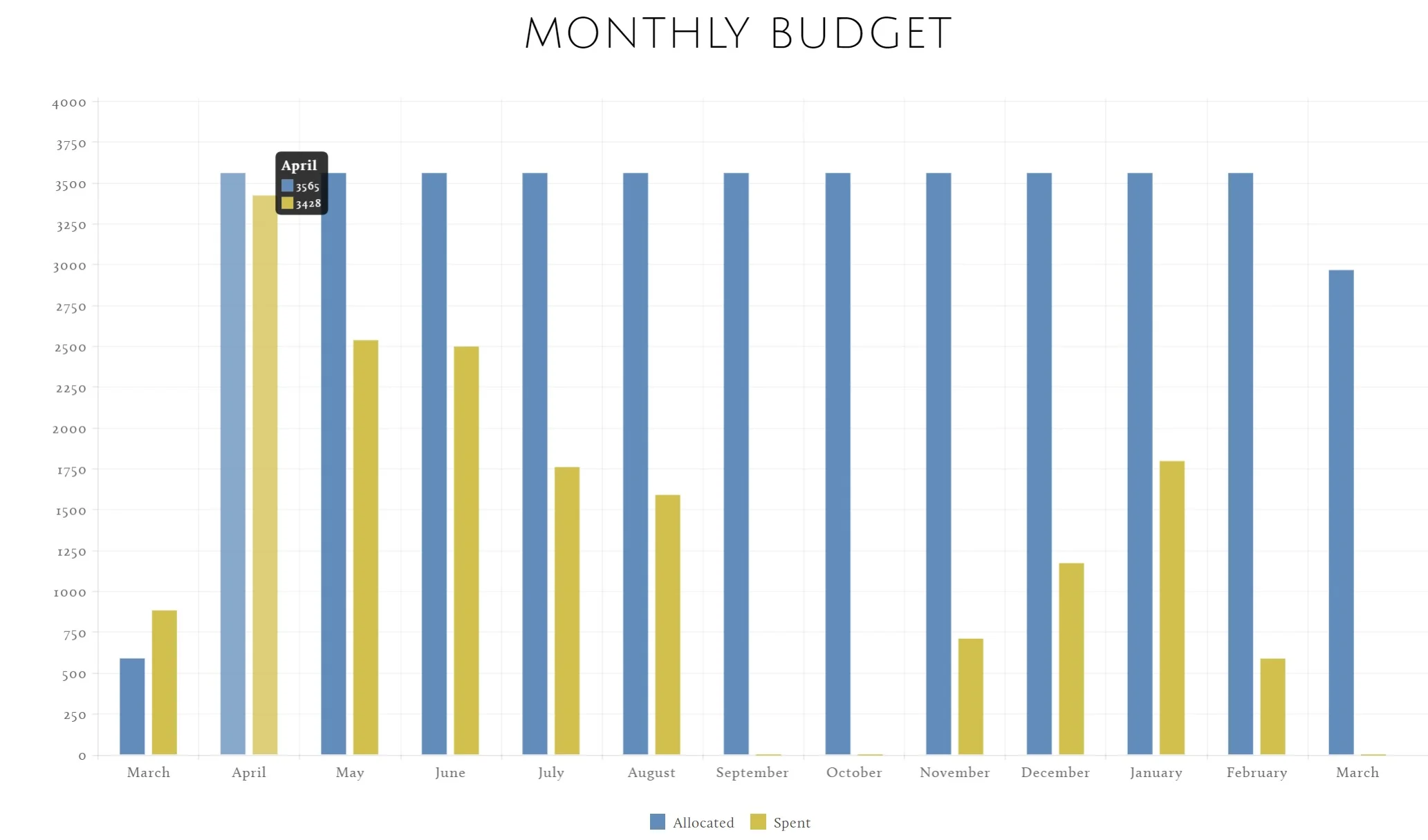

Getting Started on Your Financial Independence Journey

Step 1: Assess Your Financial Situation

Track Your Expenses: Understand where your money is going.

Calculate Net Worth: Add up all assets and subtract liabilities.

Set Clear Financial Goals: Determine how much you need to achieve Barista FIRE.

Step 2: Increase Savings and Reduce Expenses

Create a Budget: Allocate income towards necessities, savings, and discretionary spending.

Cut Unnecessary Costs: Identify and eliminate non-essential expenses.

Adopt a Frugal Lifestyle: Embrace minimalism and mindful spending.

Step 3: Generate Additional Income

Side Hustles: Freelancing, consulting, or gig economy jobs.

Passive Income Streams: Rental properties, dividend stocks, or online businesses.

Invest in Yourself: Acquire skills that can increase your earning potential.

Step 4: Start Investing

Educate Yourself: Read books, attend workshops, or consult financial advisors.

Choose Investment Vehicles:

Index Funds: Diversified and low-cost.

Retirement Accounts: 401(k)s, IRAs with tax advantages.

Automate Investments: Set up automatic transfers to your investment accounts.

Step 5: Consider Geo-Arbitrage

Research Locations: Identify areas with a lower cost of living.

Plan for Relocation: Understand visa requirements, healthcare, and cultural differences.

Remote Work Opportunities: Find jobs that allow you to work from anywhere.

Overcoming Common Challenges

"I Don't Earn Enough to Save"

Solution: Start small and focus on gradually increasing your savings rate.

Action: Look for ways to increase income, such as side jobs or skill development.

"Investing is Too Complicated"

Solution: Begin with simple investment options like index funds.

Action: Educate yourself using reputable sources and consider professional advice.

"I'm Afraid of Market Losses"

Solution: Invest for the long term and diversify your portfolio.

Action: Understand that market fluctuations are normal and focus on long-term growth.

"I Can't Relocate Due to Family or Work"

Solution: Apply geo-arbitrage locally by moving to a more affordable neighborhood or city.

Action: Negotiate remote work arrangements or find local cost-saving opportunities.

Critics of FIRE and Their Arguments

There are a few critics of the FIRE movement, so I’d like to dispel those really quick.

Firstly, it is possible to save money even if you aren’t earning money.

Secondly, under the FIRE “4% safe withdrawal” rule, you can live FOREVER on your retirement income, not just 25-30 years.

Thirdly, the Fed generally protects portfolios in major downturns.

Part 1: Starting at $0.00 - Saving money when you aren’t earning any money

So, you don’t have a job. Or, maybe you do have a job but all of the money that you earn from that job goes to paying for things you absolutely need to survive.

Food

Rent

Transportation

And basically nothing else.

So, you have no spare money left “to save.” I understand. I’ve been there too.

When I got out of the military in 2005, I started college and was “paid” via my GI Bill to cover my expenses while I was taking courses. I had no money at the time other than that income. But, the income stopped suddenly during the summer because there were no courses happening!

I didn’t account for this, and ended up rationing hot dogs and ramen noodles to survive. No, seriously… I was counting on my ketchup to keep me from starving. I was late on my rent, and they were turning off my electricity. It sucked!

“Other books, blogs, and podcasts continue to refine and promote the FIRE concept, including Financial Freedom author Grant Sabatier, who works closely with Vicki Robin and popularized the idea of side hustling as a path to accelerate financial independence.”

The trick here is exactly that, “a trick.” A trick is what some people call “hustling” or having a “side hustle” to earn extra money. Back then I didn’t understand what that was because it really wasn’t defined that way at the time. Picking up a part-time job was the “trick” back then. But since then, there’s been a whole slew of new ways to make money on the side that don’t involve having a job of any sort.

Things you can do while you are sitting at home, or - in my case - sitting outside at a café in a foreign country, that will keep earning you money - on the side - from anywhere in the world. Eventually, they'll be earning you enough side money on a monthly basis to completely replace your regular income source and you'll find yourself thinking about how free you really are now, compared to before.

We teach about these “side hustles” in our Nomad Guide, but for now it is suffice to say that you can earn money by

picking up a remote job

renting out your car when you’re not using it,

becoming an Uber driver,

creating courses that you can sell online with skills you already know and are good at,

becoming an online freelancer or consultant through Upwork,

being a tour guide in your own town or city through Airbnb experiences,

becoming a yoga instructor,

or even an on-the-side photographer.

The point is, we are living in an age where the “side hustle” is so easy to attain that you don’t need anyone else’s permission. And you don’t have to have any experience in any of them. So you can start earning a “side income” that you can then use to save the money you need for growing your investments. Starting at $0.00.

Just commit to it, and then tell yourself “this extra money isn’t for me, or for anyone else. It’s feeding my investment account and nothing else.”

That's pretty much how I got started as well. Although I did find a part-time job in my college years, I have rented out my spare room on Airbnb, I have rented out my car on Turo, I became a consultant, and I was even a tour guide for awhile.

Now, most of the money that I earn is the residual income that I receive from the investments that I made. This is because I used the money that I earned through these methods to invest - so my money would then work for me - and now I earn additional income through blogging as well. It can be done!

Part 2: You can live FOREVER on your Retirement, not just 25-30 years!

ARGUMENT: Based on their “4% safe withdrawal” rule, pulling out 4% of your total investment would deplete your portfolio in 25 years!

One of the rules in “FIRE” is the “4% safe withdrawal” rule - which means that you could safely withdraw 4% of your investment savings per year in retirement. If you started out with your full investment savings and took away 4% every single year, you would end up with 0% of your investment account in 25 years. That is simple math. And that is the argument that it won’t last forever. It’s a simple minded argument that is also wrong.

Why? Because that assumes that you pull it all out and thus it doesn’t account for investment gains during retirement.

Sure, you could pull out all of the money and then use a little bit each year until it’s gone, but the smarter way is to simply leave it in and live off of the money that your money is making for you.

Because investments ALSO EARN 6-12% per year, on average. So, if you start with $100,000 and your investment earns just 6%, your balance would increase to $106,000. If you then took out 4% of the initial $100,000 - your total wouldn’t drop to $96,000. It would have INCREASED to $102,000 because you took out $4,000 but you earned $6,000 in interest and dividends.

In other words, if you keep taking out 4% while you are gaining MORE than 4%, you could live FOREVER on just the interest on dividends without ever taking out ANY of the initial investment!

Once you’ve accumulated enough money to retire, you could use that money to live on.

Thus, if you were able to save 75% of your income for 10 years, you wouldn’t need to withdraw ANY of your money. You could just live off of the interest and dividends that you receive every year!

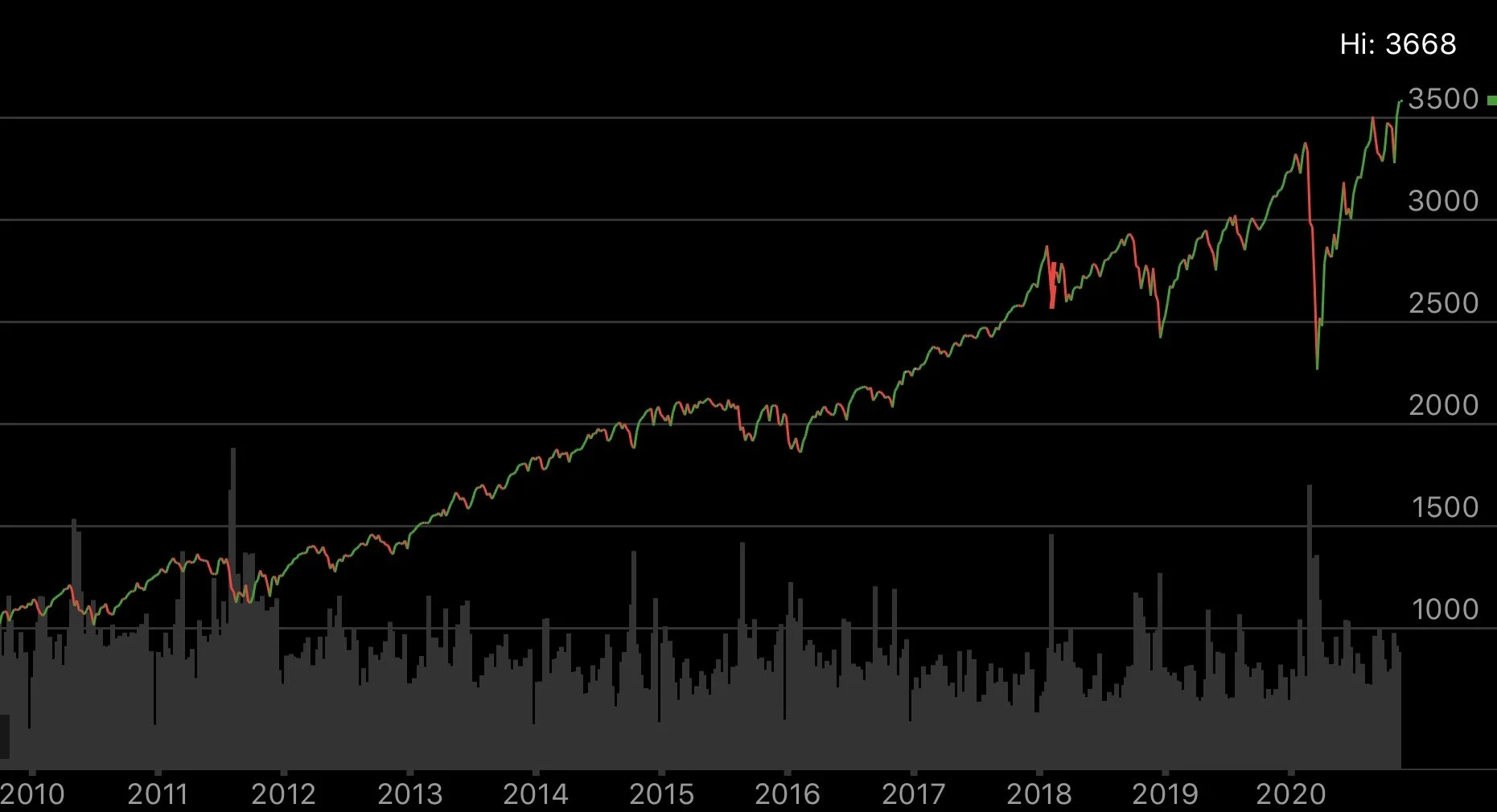

Part 3: The Fed generally protects portfolios in major market downturns

The good news for the lay-investor is that the Fed typically has your back, especially if you are an American, but also in the EU, UK, Japan, and a few other major developed countries. Actually, you don’t need to be FROM one of these countries either - as long as you create an account in one of those countries you’ll also be protected.

What does this mean? Essentially what it means is that even though there is no “FDIC” of the investment world to protect you from investment losses on a day to day basis – which you don’t need because it’s been proven throughout time that holding investments over the long term will average out any losses to the positive side – the Fed and other Federal Reserve Banks will typically step in during the case where you could take major losses - like during economic recessions and depressions.

In other words, if there is a major shock in the market that would cause you to lose a massive amount of money, they’ll fix the problem from their end and your investments will likely recover much quicker than you expected.

This was true in the Great Recession of 2007-2009, and it is true during the Coronavirus Depression of 2020. The Fed’s policies stopped the freefall in the stock market and completely reversed it. Even if stocks decline again during this period, I am confident that the Fed will “find a way” to correct the issue from the monetary side yet again, and that is the side that protects your investment portfolio.

Commitment to the FIRE Method

Now that you are confident in the fact that the FIRE method will work, and that you can start earning money on the side to invest into this method, it’s time to get started. The FIRE Movement started on the book “Your Money or Your Life” and then was improved by a few others over the years.

So, once you have a few dollars, we recommend buying these FIRE books to get started:

If you can’t afford any of those books just yet, start doing some serious research about the FIRE community on the internet. You can start by joining other FIRE based groups on Facebook such as these ones:

Or by checking out this article:

Once you’ve joined these groups, searched more about FIRE on the internet, and read these books, you’ll be ready for the real first steps: opening your investment account, starting up your side hustle(s), and choosing your first investments.

Making it to Barista FIRE and achieving Financial Freedom

Embarking on the journey toward financial independence doesn't have to be overwhelming or reserved for high earners. By understanding the principles of the FIRE movement and considering strategies like Barista FIRE and geo-arbitrage, you can tailor a plan that fits your unique circumstances and goals.

Remember, achieving financial freedom is a marathon, not a sprint. Start by taking small, consistent steps—like saving a little more each month, learning about investing, or exploring ways to reduce your living expenses. Over time, these efforts compound, bringing you closer to a lifestyle where you have the freedom to choose how you spend your time, whether that's traveling the world, pursuing passions, or simply enjoying more flexibility in your day-to-day life.

Want to learn more? Check out this article:

Return the favor by sharing this article with your friends. Thanks!

FAQs

What is the difference between Barista FIRE and traditional FIRE?

Answer: Traditional FIRE involves saving enough to completely cover your living expenses indefinitely without the need to work. Barista FIRE reduces the savings target by combining investment income with part-time work, allowing you to achieve financial independence sooner.

How much do I need to save for Barista FIRE?

Answer: The amount varies based on your personal expenses, desired lifestyle, and income from part-time work. A common approach is to save enough to cover 50-75% of your expenses through investments and use part-time work to cover the rest.

Is investing risky for beginners?

Answer: All investments carry some risk, but starting with diversified, low-cost index funds can mitigate many risks. It's important to invest for the long term and not react impulsively to market fluctuations.

How can I start investing with little money?

Answer: Many investment platforms allow you to start with small amounts. Consider micro-investing apps, opening a retirement account, or investing in fractional shares.

What are some practical ways to reduce living expenses?

Answer: Create a budget, eliminate unnecessary subscriptions, cook at home, use public transportation, and consider downsizing your housing.

How does geo-arbitrage work if I can't move abroad?

Answer: You can apply geo-arbitrage domestically by moving to areas with a lower cost of living within your country. Additionally, you can seek remote work opportunities that allow you to live in more affordable locations.

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website: EatWanderExplore and REmotiFIRE.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Tech Elevator Demystified: Reviews, Legitimacy, and Winning Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008329038-96GH4TTYZATP6N3WDWXR/tech_elevator.png)

![Cracking the Code: Coding Dojo Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707007756149-VSJNN2PHHX2RWK6RSVQM/coding_dojo.png)

![App Academy Unveiled: Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008090320-IUIIV4T416FP5ILRGK5W/app_academy.png)

![CareerFoundry Decoded: Reviews, Legitimacy, and the Best Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008030234-CZTE1805JUCU2M2GK7RO/careerfoundry.png)