FIRE Community & Investment Strategies

Building Wealth Through Sustainable and Ethical Investing

Discover how to build wealth sustainably with investment strategies that align with your values and the principles of the FIRE movement. From low-cost index funds to ethical investing, explore our curated articles and guides designed to empower you on your journey to financial independence.

Investment income is a key component for many in achieving financial independence and the freedom to travel the world continuously.

Embracing FIRE Principles

At The Sustainable Nomadic Financial Advisor, we highly advocate for the FIRE method. Leveraging Bradley's background in finance, investments, and portfolio management, we've developed investment strategies that not only aim for financial growth but also align with sustainable and ethical values.

Emphasizing Education and Empowerment

We believe that people should be empowered with knowledge to make informed investment decisions that align with their financial goals and personal values. Our blog and resources aim to educate on sustainable investing practices that support both financial independence and a positive global impact.

Our Core Investment Philosophy

Long-Term Focus: Prioritizing investments that grow steadily over time.

Low-Cost Index Investing: Utilizing diversified index funds and ETFs to minimize fees and maximize returns.

Risk Management: Balancing portfolios to align with individual risk tolerance and financial goals.

Passive Income Generation: Creating income streams that support your lifestyle without constant oversight.

Sustainable and Ethical Choices: Selecting investments that meet Environmental, Social, and Governance (ESG) criteria.

Geoarbitrage Strategies: Discuss how living in lower-cost countries can accelerate financial independence.

Important Considerations

Personalization: Tailor strategies to individual risk tolerance, financial goals, and ethical considerations.

Due Diligence: Research thoroughly or consult a financial advisor before implementing complex or high-risk strategies.

Risk Management: Diversify investments and maintain an appropriate asset allocation to mitigate risks.

Ethical Investing: Many in the FIRE community are embracing sustainable and socially responsible investing (SRI) and Environmental, Social, and Governance (ESG) criteria.

Community Support: Engage with the FIRE community for shared experiences, support, and accountability.

By understanding and applying these core strategies and considering the alternatives, individuals pursuing FIRE can create a robust plan tailored to their unique circumstances and values. The emphasis remains on achieving financial independence in a way that supports long-term well-being and life satisfaction.

We focus on investment strategies that prioritize sustainability, ethical considerations, and long-term growth, aligning our offerings primarily with the core principles of the FIRE community. We encourage you to explore our articles and guides to enhance your understanding and confidence in managing your investments.

Investment Guides

Comprehensive Guide to Sustainable Investing for FIRE

This guide provides an in-depth look at how to build a portfolio that aligns with your ethical values without sacrificing returns.

Get Personalized Advice

For personalized investment strategies tailored to your unique situation and goals, schedule a free consultation with us today.

Core Strategies Used in the FIRE Community

-

Living Below Your Means: Reducing expenses significantly to increase savings.

Budgeting and Expense Tracking: Monitoring expenses to identify cost-cutting opportunities.

Minimalism and Mindful Spending: Focusing on necessities and prioritizing spending on what truly adds value.

Extreme Savings Rates: Saving a high percentage of income (often 50% or more) to reach FIRE rapidly.

DIY and Self-Sufficiency: Growing food, repairing instead of replacing items, and reducing consumption.

-

Index Fund Investing: Investing in low-cost, broad-market index funds or ETFs.

Diversification and Asset Allocation: Spreading investments across various asset classes to minimize risk.

Buy and Hold Strategy: Holding investments long-term to benefit from compound growth.

Low Fees: Minimizing investment costs by choosing funds with low expense ratios.

-

Maximizing Contributions: Fully utilizing 401(k)s, IRAs, Roth IRAs, and HSAs.

Tax-Efficient Fund Placement: Strategically placing investments in taxable vs. tax-advantaged accounts.

Backdoor Roth IRAs and Roth Conversion Ladders: Employing strategies to minimize taxes over time.

Employer Matches: Taking full advantage of employer 401(k) matching programs.

Tax-Loss Harvesting: Selling investments at a loss to offset capital gains taxes.

-

Emergency Fund Establishment: Keeping 3-6 months' worth of expenses in accessible savings.

Managing Risk with Asset Allocation: Balancing the investment portfolio across different asset classes.

Increasing Bond Allocation: Shifting towards bonds or fixed-income securities to reduce volatility as one approaches retirement.

Health Savings Accounts (HSAs): Utilizing HSAs for medical expenses with a triple tax advantage and potential investment growth.

-

The 4% Rule: Planning retirement withdrawals around a 4% annual rate to ensure portfolio longevity.

Flexibility: Adjusting withdrawal rates based on market performance and personal circumstances.

Monte Carlo Simulations: Using statistical models to assess the probability of retirement success.

-

Maximizing Earnings: Pursuing higher-paying careers and negotiating raises.

Skill Development: Investing in education and certifications to enhance income potential.

Job Hopping and Career Hacking: Changing employers or roles for better compensation and opportunities.

-

Continuous Learning: Reading books, blogs, and attending workshops on personal finance and investing.

Engaging in the FIRE Community: Participating in forums, meetups, and online groups for support and knowledge sharing.

Mentoring and Sharing Knowledge: Helping others on their path to financial independence.

-

Barista FIRE, Coast FIRE, Fat FIRE: Tailoring financial independence to individual goals and desired lifestyles.

Geo-Arbitrage and Nomadic Living: Relocating to lower-cost areas or countries to stretch savings and accelerate FIRE.

Articles on FIRE’s Core Strategies

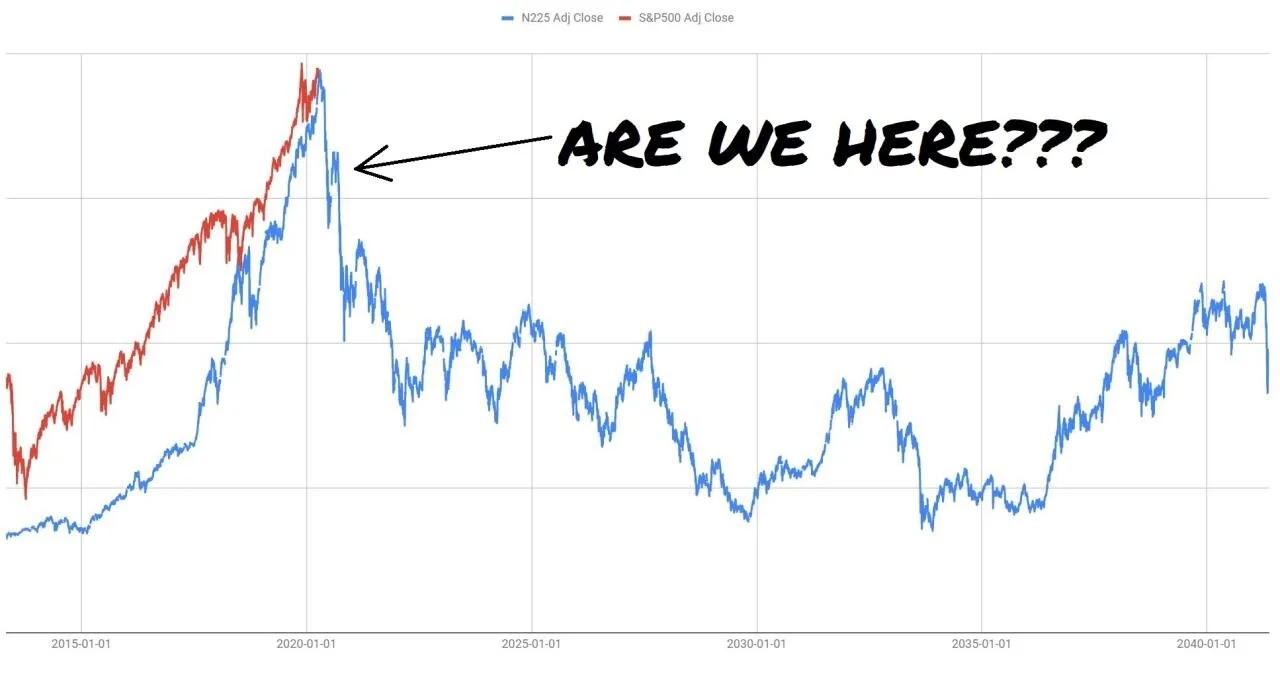

Get insights on how to stay the course during market volatility and potentially capitalize on lower asset prices.

Alternative Strategies Discussed in the FIRE Community

-

Rental Properties and House Hacking: Generating passive income by owning and renting out properties.

REITs and Crowdfunding Platforms: Investing in real estate without direct property management.

Alternative Real Estate Investments: Engaging in private equity deals and syndications for potentially higher returns.

-

Dividend Growth Investing: Investing in companies with a history of increasing dividends.

Reinvesting Dividends: Using dividend payments to purchase more shares and compound growth.

Passive Income Generation: Creating income streams to cover living expenses through dividends and interest.

-

ESG Investing: Focusing on companies that prioritize environmental sustainability, social responsibility, and ethical governance.

Impact Investing: Investing in projects and companies that make a measurable, positive impact on society and the environment.

-

Cryptocurrency Investing: Allocating a small portion of the portfolio to digital assets like Bitcoin or Ethereum, acknowledging the high risk and volatility.

Precious Metals and Commodities: Investing in gold, silver, or commodities as a hedge against inflation and market uncertainty.

-

Interest Income: Earning returns by lending money to individuals or businesses through online platforms.

Risk Management: Diversifying loans to mitigate default risk and enhance returns.

-

Starting or Buying a Business: Generating income and building equity through entrepreneurship.

Passive Business Models: Setting up businesses that require minimal active management, such as online ventures or franchising.

-

Dollar-Cost Averaging: Continuing to invest regularly regardless of market conditions to reduce the impact of volatility.

Buying the Dip: Investing additional funds when market prices are low to capitalize on future growth.

Maintaining Discipline: Staying the course during volatility and avoiding emotional reactions to market fluctuations.

Articles on FIRE’s Alternative Strategies

Note: The strategies above vary in risk, complexity, and alignment with FIRE principles. The core strategies tend to focus on simplicity, low cost, and long-term growth, while alternatives may offer higher returns but come with increased risk and require more active management.

Strategies Typically Discouraged in the FIRE Community

-

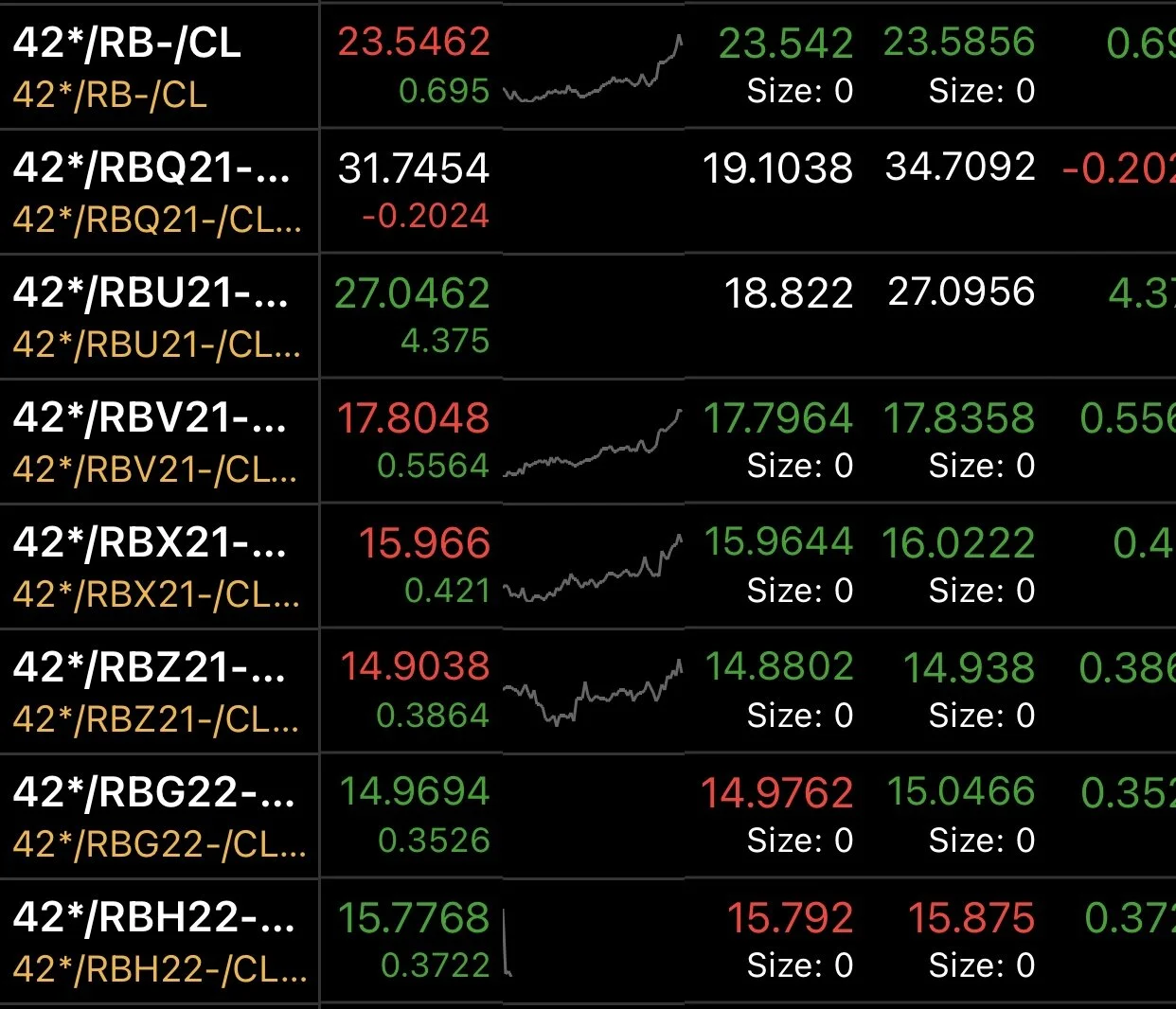

Derivatives Trading: Using options and other derivatives to hedge portfolios or speculate on market movements.

High Complexity and Risk: Recognizing the need for advanced knowledge and the potential for significant losses.

-

Active Management: Attempting to predict market movements to adjust investments, which can lead to underperformance.

Sector Rotation: Moving investments between sectors expected to outperform, increasing complexity and risk.

-

Permanent Life Insurance Policies: Using whole or universal life insurance for cash value accumulation.

High Fees and Lower Returns: Weighing the costs and often lower returns compared to traditional investments, making it less favorable.