Rediscovering the Middle-Class Dream: How Geoarbitrage and Remote Skills Can Bring It Back

FIRE Community > The Vanishing Middle-Class Dream & How Geoarbitrage Can Bring It Back

The Middle-Class Lifestyle: A Dream That’s Slipping Away

Have you ever felt like you’re working harder than ever, yet the classic “American Dream” keeps slipping through your fingers? If so, you’re not alone. Millions of people who identify as middle class are watching housing costs soar, childcare prices balloon, and retirement options shrink—all while their paychecks barely inch upward. But what if there’s another way to live that dream, minus the crushing debt and endless hustle?

In this article, we’ll explore why the middle-class lifestyle has become almost unrecognizable, what forces have made it so hard to get ahead, and how a modern approach called “geoarbitrage” can offer a practical escape route. By the end, you’ll see there’s hope for reclaiming that comfortable life—just not in the way you might expect.

1. Once Upon a Time: The Vanishing Middle-Class Dream

Picture life in 1970s America: a single middle-class income could buy a home, fund a reliable car, support multiple kids, and still leave enough for a yearly vacation and a solid retirement. This wasn’t a fantasy. It was the standard for countless families.

Then everything changed. Fast-forward to today, and the cost of living has skyrocketed while wages barely moved. Home prices are now six times higher than the average salary; college tuition has skyrocketed; and the days of solid pensions are mostly gone. What used to be “comfortable” has become “barely making it.”

A Quick Look at Then vs. Now

Median Home Price (1970): $17,000 (about $118,700 in today’s dollars)

Median Home Price (2025): $419,200

Median Income (1970): $9,870 (about $68,700 in today’s dollars)

Median Income (2025): $68,700

In 1970, a home was about 2.5 times the median salary. Now it’s over 6 times. Child-raising costs doubled. Vacations costs tripled. Retirement funds? Mostly on you. The math no longer works.

Defining the Middle Class

The term "middle class" often brings to mind a comfortable lifestyle with stable income, homeownership, and the ability to afford necessities and some luxuries. But who exactly falls into this group, and how is it structured? Let's break it down in relatable terms.

In the United States, the middle class encompasses households earning between $56,600 and $169,800 annually for a family of three [source: pewresearch.org]. Pew typically defines “middle class” as households earning between two-thirds and double the national median income (adjusted for household size and local cost of living).

This range varies based on factors like family size and location. As of 2023, the median household income was $80,610 [source: census.gov].

Income Distribution Within the Middle Class

Imagine dividing the middle class into three equal parts to understand how income is spread:

Lower Middle Class: This group earns between $56,600 and $80,610 annually. They often manage essential expenses but may find it challenging to afford significant luxuries or save extensively.

Mid-Middle Class: Earning around the median income, $80,610, these households can cover necessities and afford some discretionary spending, with modest savings.

Upper Middle Class: With incomes between $80,610 and $169,800, this segment enjoys greater financial flexibility, allowing for more comfortable lifestyles and better savings potential.

Upper Class Households: Households earning above $169,800 annually fall into this category, often affording a more affluent lifestyle with significant savings and investment opportunities. Households earning this amount of income are not considered “middle class.”

Percentage of Americans in Each Group

As of 2022, about 52% of U.S. adults were considered middle class [source: investopedia.com]. This percentage has trended slightly downward over the decades (from about 61% in 1971) as more families either move into higher-income brackets or drop into lower-income ones. This means that just over half of the adult population falls within the income ranges described above.

However, as of September 2024, 77% of American workers would experience financial difficulty if their paycheck were delayed by a single week, suggesting a persistent vulnerability to income disruptions [source: prnewswire.com].

Why Understanding This Matters

Recognizing where you stand within these groups can provide perspective on financial health and help set realistic goals. It also sheds light on the economic challenges different segments face, especially as the cost of living rises and income growth remains uneven.

Understanding the structure of the middle class offers valuable insights into economic well-being and the diverse experiences of American households.

The Financial Reality Check: What’s Changed?

Let’s break down the costs of what was once considered a standard middle-class life:

Two generations ago, a middle-class salary meant a comfortable and stable life for most American families. In the 1970s and 1980s, the typical middle-class household could afford to buy a home, drive a new car, raise three or four children, take annual vacations, and still retire comfortably—often on a single income. In 1970, the median home price was just $17,000 (equivalent to $118,700 in today’s dollars), while the median household income was about $9,870 (or $68,700 in 2024 dollars). At that time, the cost of a home was only 2.5 times the median annual income, making homeownership an achievable goal for most middle-class families.

Home, Car, and Childcare Costs

By contrast, today’s median home price has soared to $419,200—over six times the median household income—placing homeownership far out of reach for many middle-class earners without significant financial strain or dual-income households. Similarly, in 1970, a new car cost about $3,450 (around $24,100 in today’s dollars), while in 2024, the average price of a new car has risen to $37,800, making car ownership a growing financial burden. The cost of raising children has also skyrocketed, with estimates from the Brookings Institution indicating that it now takes over $310,000 to raise a child to age 18—double what it cost in the 1970s after adjusting for inflation.

Vacations and Retirement

Annual vacations, once a hallmark of middle-class life, have become less common. In 1970, a family of four could take a week-long vacation for around $500 (about $3,500 today), but with rising costs in airfare, hotels, and entertainment, that same vacation now costs $5,000 - $10,000, making regular travel increasingly difficult for middle-class households. Meanwhile, retirement security has eroded. While past generations could rely on employer pensions, today’s workers must self-fund their retirement, with many struggling to save amid increasing expenses.

The Bottom Line

This wasn’t just a fantasy—it was a reality for millions of American families. The middle-class dream was built on affordable home prices, reasonable living costs, and stable wages that kept pace with inflation. But over the last few decades, wage growth has stagnated, while the cost of living has skyrocketed—leaving today’s middle class with a diminished version of the American Dream that often requires two incomes, significant debt, and little financial security.

So, in 1970, a home cost just 2.5 times the median income. Today? It's over 6 times that. The cost of raising kids and college tuition has skyrocketed, while wages have barely budged in comparison. A new car, once an accessible purchase for a middle-class family, now requires a hefty loan.

Simply put, the numbers don't add up. The traditional middle-class life now requires a HIGH upper-middle-class income—around $150,000 per year. And most households don't make anywhere close to that (note the median household income of $80,610). You’d basically need 2 families to live together to afford that lifestyle these days.

Inflation 1910 until 2022 via InflationData.com shows that inflation drastically began increasing after 1970.

2. What Happened? The Economic Storm that Changed Everything

The fact that the middle class feels squeezed isn’t in your head—it’s real. Several key forces combined to make a once-accessible life painfully out of reach.

2.1 Wage Stagnation vs. Cost Inflation

Wages: Adjusted for inflation, the median household income rose only 17% between 1979 and 2023.

Housing: Meanwhile, home prices jumped 250%.

Healthcare: Family health insurance premiums increased by 314% since 1999.

College Tuition: Public university costs are up 150% since 1980.

Conclusion: Everyday essentials—housing, healthcare, education—became dramatically more expensive, but paychecks lagged behind.

2.2 Housing: The American Dream Slips Away

Homes used to cost around 3x the average salary; now they can cost 6x or more.

Rent in major cities eats up 40%–50% of income, leaving little left for saving.

Millennials and Gen Z are struggling to enter a market that older generations once took for granted.

2.3 Childcare & Education: Twice the Price, Half the Options

Raising a Child: $145,000 in 1960 (inflation-adjusted) vs. $310,000 today.

Daycare: Often more expensive than in-state college tuition.

Student Debt: Soared from $260 billion in 2004 to $1.7 trillion today ($1,700 billion).

2.4 Retirement: From Pensions to Personal Panic

Pensions: 60% of private-sector workers had them in 1980; only 15% do now.

401(k) Reality: The average account balance for near-retirees provides less than $500/month.

Social Security: With potential cuts looming, it’s not enough to rely on alone.

The Bottom Line: The old formula—work hard at a steady job, buy a house, save for retirement—just isn’t adding up anymore. For many, the dream has turned into a grind.

3. The Breaking Point: “Work Hard & You’ll Be Fine” Is No Longer True

You can put in the hours, budget carefully, and still come up short. That’s not laziness; it’s a systemic problem. The U.S. median income is around $68,700, but living a so-called “middle-class life” often requires at least $150,000—well over double.

So what do you do if you don’t have that kind of salary? That’s where geoarbitrage comes in.

4. Enter Geoarbitrage: The New Middle-Class Hack

Geoarbitrage is about earning a strong currency (like the U.S. dollar or Euro) while living in places where your money stretches further. Tim Ferriss popularized the term in The 4-Hour Workweek, and in today’s remote-work economy, it’s more accessible than ever.

4.1 What Is Geoarbitrage?

Definition: You live in a lower-cost country but earn your income in a higher-value currency.

Result: Your salary effectively becomes much larger. A $60,000 annual income might feel like $150,000 in Portugal, Thailand, or Mexico.

4.2 Where Can You Live a Middle-Class Life for Less?

Countries like Portugal, Mexico, Thailand, Malaysia, and Colombia offer comfortable lifestyles for $1,200–$3,500/month. Picture affording private healthcare, nicer housing, and regular travel—without feeling financially squeezed.

A $5,000/month salary in the U.S. gets you a lower-middle-class life. But in Thailand or Portugal, it can provide a lifestyle comparable to earning $150K in the U.S.—a nice home, private schools, domestic help, great healthcare, and vacations without debt.

Geoarbitrage FIRE Calculator

Calculate how geoarbitrage accelerates financial independence by working remotely in a lower-cost country.

Geoarbitrage Scenario

Results

Geoarbitrage Scenario:

Discretionary Income: $0 / year

Savings Rate: 0%

FIRE Number: $0

Projected Retirement Age: N/A

Work Location:

Retirement Location:

A home and yard in Costa Rica

5. Bringing Back the 1970s Lifestyle: How Geoarbitrage Makes It Possible

Think of it as hitting the “reset” button on prices. In places with lower housing costs and cheaper everyday expenses, you can recapture the comfortable rhythm of life that was once standard in America.

5.1 Real-World Example: Portugal

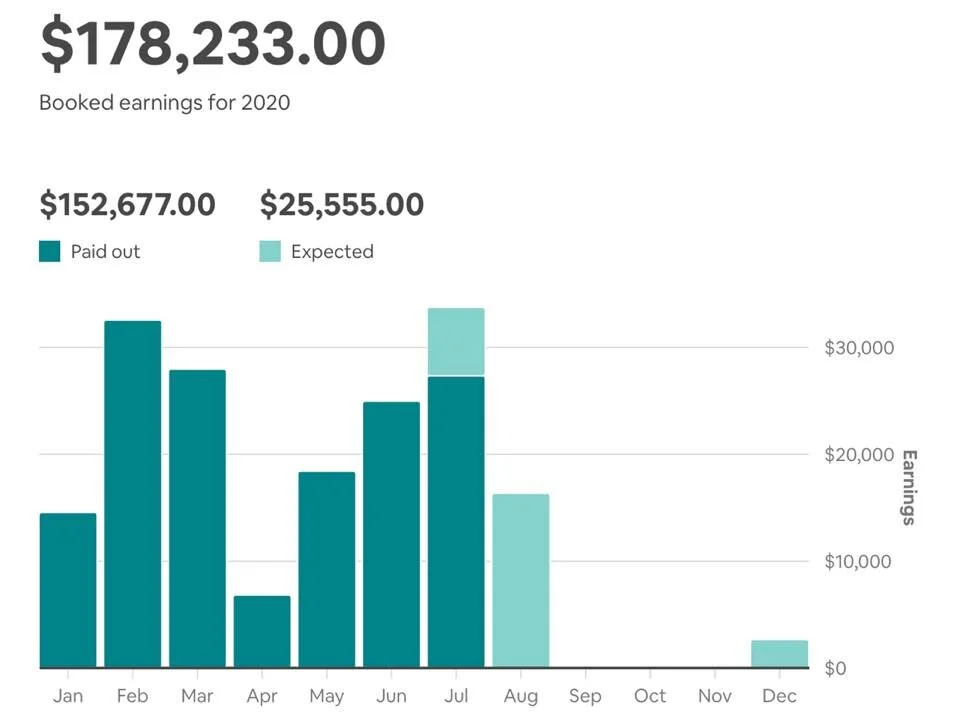

Annual Income (Remote Tech Job): $145,397

Home Price: $250,000 vs. $419,200 in the U.S.

Car Price: $27,000 vs. $37,800 in the U.S.

Child Raising Costs: $100,000 vs. $310,000 in the U.S.

Vacation: $4,000 instead of $7,500 in the U.S.

Monthly Expenses: $2,500 can cover most needs, freeing up tens of thousands for savings and investments.

Outcome

Instead of a paycheck-to-paycheck grind, you’d retain $70,000+ annually for saving, investing, and enjoying life—mirroring the financial comfort your parents or grandparents might recall from the 1970s.

6. Making Geoarbitrage Your Reality: The Remote Work Revolution

Of course, not every employer lets you work from a beach in Bali. So how do you secure a job that pays in dollars or euros but lets you live anywhere?

6.1 The Key: Remote-Friendly, High-Demand Skills

Why Tech and Coding?

High Salary Potential – Even entry-level developers can earn $60,000–$100,000.

Global Demand – Companies worldwide need tech talent.

Remote-First – Tech was pioneering remote work long before it became mainstream.

No Degree Required – You can learn online with focused training and a portfolio.

6.2 The Remote Coding Bootcamp

If you’re nodding along, thinking, “This sounds great, but I have no idea how to code,” there’s good news. The Remote Coding Bootcamp was created to bridge that gap for everyday people:

100% Remote – Learn from anywhere in the world.

Affordable – At $497, it’s far less than the $10K–$15K many bootcamps charge.

Job-Focused – Skips the fluff and teaches real skills employers want.

Geoarbitrage Ready – Tailored to help digital nomads and expats thrive.

6.3 Not Sure About Tech or Coding?

For those who aren’t sure about tech or coding, there are other options. You can check out this interactive remote job tool that will help you decide which remote jobs fit your background, experience, and desires best - plus it’ll help stare you in the right direction to get you started.

7. Your Two Choices: Stay Stuck or Try Something New

The classic middle-class blueprint—steady job, house in the suburbs, comfortable retirement—has been derailed. But that doesn’t mean you’re doomed to stress and debt.

You can forge a path to the life you’ve always wanted. Here are your options:

Keep Trying the Old Way: Continue paying for a life that gets more expensive every year.

Pioneer Your Own Path: Learn a high-paying remote skill and use geoarbitrage to reclaim a lifestyle that feels like the 1970s again—only with better Wi-Fi.

8. Final Thoughts: The Dream Isn’t Dead—It’s Just Moved

If you’re waiting for America’s middle-class paradise to return, you may be waiting forever. But if you’re open to living abroad and embracing remote work, the dream is alive and well. The world is big, and opportunities for a comfortable, financially secure life are everywhere—if you know where to look.

Ready to escape the struggle?

Learn a remote skill (coding is our favorite choice).

Choose a geo-friendly destination (we list many other great locations here).

Reclaim the lifestyle your parents or grandparents took for granted.

Ready to Get Started?

If you’re serious about changing your life, the Remote Coding Bootcamp can equip you with the skills to work remotely, earn in dollars, and live in a place where your money goes further. It’s the fastest, most affordable way we know to say goodbye to the middle-class squeeze—and hello to a life that truly feels free.

Learn more and take the first step toward your new life.

Free Training: How to Retire Within 10 Years

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Tech Elevator Demystified: Reviews, Legitimacy, and Winning Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008329038-96GH4TTYZATP6N3WDWXR/tech_elevator.png)

![Cracking the Code: Coding Dojo Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707007756149-VSJNN2PHHX2RWK6RSVQM/coding_dojo.png)

![App Academy Unveiled: Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008090320-IUIIV4T416FP5ILRGK5W/app_academy.png)

![CareerFoundry Decoded: Reviews, Legitimacy, and the Best Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008030234-CZTE1805JUCU2M2GK7RO/careerfoundry.png)