Leave the USA: Countries That Let You Move Abroad on Retirement Income, SSDI, VA, or Investments

Blue falls in Costa Rica

Move Overseas > Countries That Let You Move Abroad on Retirement Income, SSDI, or VA Benefits

(Including 401(k) payouts, pensions, and legal student-visa options - updated for 2026)

You don’t need to be rich.

You don’t need a job offer.

You don’t need to “wait until retirement age.”

You just need steady income and the right visa.

As of January 26, 2026, people living on Social Security, SSDI, VA disability, pensions, annuities, or structured retirement withdrawals (401k / IRA) there are countries that legally welcome you long-term based on that income alone as long as the income is documented, consistent, and fits the visa category.

This guide explains what actually counts as income and which 10 countries are still realistically accessible in 2026, then it gives country-to-country “visa hopping” routes you can use short-term while you apply for residency (without overstaying) and also how student visas can legally open additional countries when retiree visas aren’t an option.

Critical clarification about benefits abroad

✅ Social Security retirement → usually payable abroad

✅ SSDI → usually payable abroad

✅ VA disability → payable abroad

❌ SSI → usually stops after ~30 days outside the US

FAQ

Can I keep my SSDI or VA disability if I move abroad?

In most cases, yes. SS retirement and SSDI are generally payable abroad, and VA disability is payable abroad. (SSI is the one that usually stops.)

Is Panama really 180 days visa-free for US citizens?

US tourists can stay in Panama up to 180 days visa-free.

Can I stay in Costa Rica 180 days automatically?

Not automatically. Costa Rica often allows up to 180 days, but the entry stamp controls your allowed stay.

What’s the Schengen limit if I want Portugal?

Schengen is 90 days in any 180-day period for short stays.

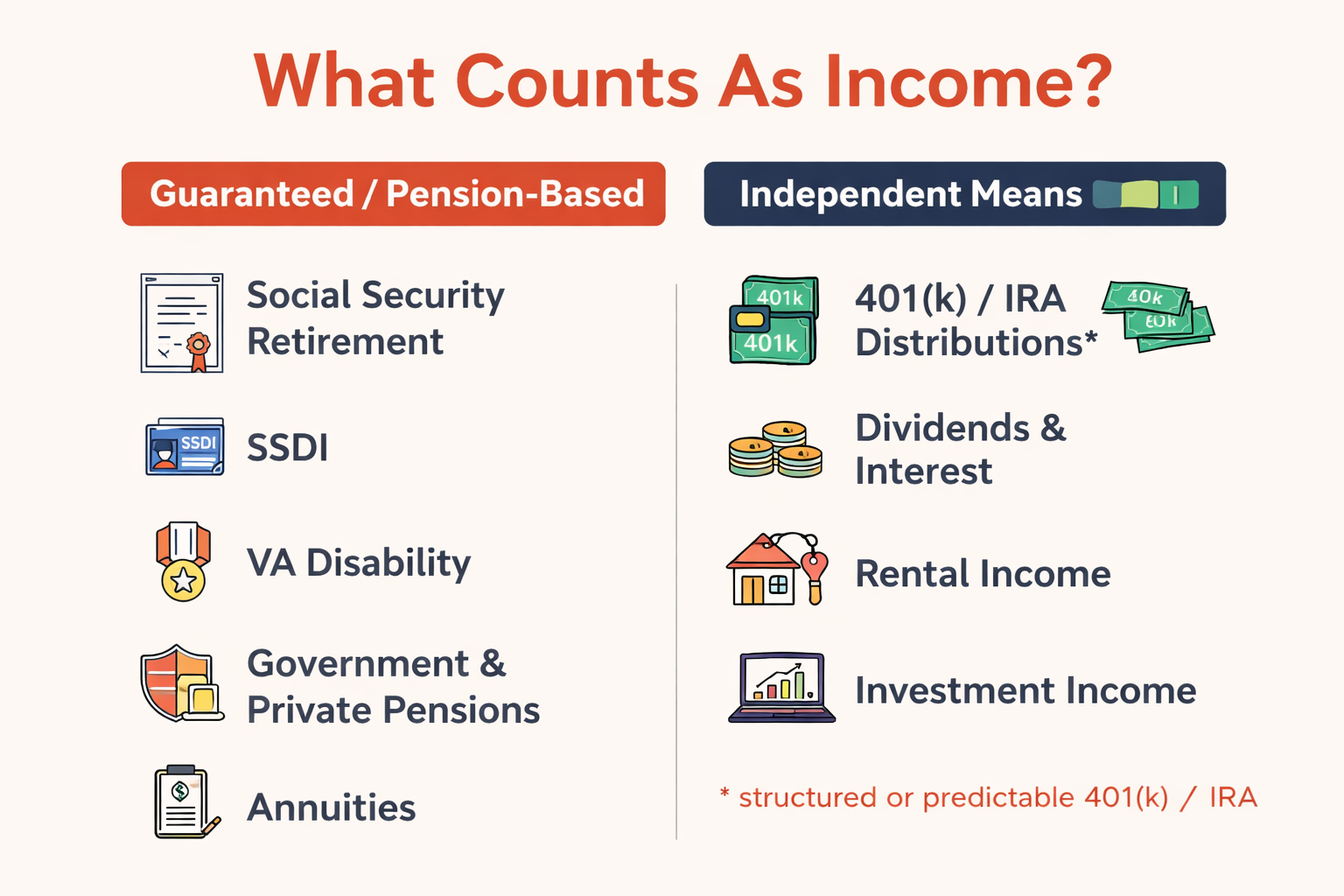

First: what income actually counts (this is where most people get confused)

Most long-stay visas fall into two different legal buckets. Mixing these up causes denials.

Bucket 1: “Guaranteed / Pension-Based” visas

(Stricter, but very stable)

These visas usually prefer lifetime or government-backed income.

Commonly accepted:

Social Security retirement

SSDI (note: SSI is excluded)

VA disability

Government pensions

Private defined-benefit pensions

Annuities that guarantee monthly payouts

Sometimes accepted (case-by-case):

401(k) / IRA withdrawals if structured and predictable

Long-term annuitized retirement income

Countries that lean heavily toward this bucket:

Panama (Pensionado)

Costa Rica (Pensionado)

Philippines (SRRV Pensioner track)

Bucket 2: “Independent Means / Passive Income” visas

(More flexible - best fit for 401k & investment income)

These visas care less about where the money comes from and more about:

consistency

sustainability

documentation

Commonly accepted:

pensions (public or private)

401(k) / IRA monthly withdrawals

dividends and interest

rental income

investment income

mixed income sources

Countries in this category:

Portugal (D7)

Mexico (Temporary Residency)

Ecuador

Uruguay

Türkiye

Thailand (multiple routes)

Malaysia (MM2H variants)

If your income is primarily 401(k)/IRA-based, this bucket is usually safer.

Balloons at sunrise in Turkey.

10 Countries that still accept SS, SSDI, or VA income as of January 26, 2026

1. Panama: Pensionado Visa

Status: Active in 2026

Income benchmark: ~$1,000/month (+ dependents)

Best for: SS, SSDI, VA, annuities

401(k): works best if annuitized or clearly sustainable

Panama remains one of the most predictable retiree systems, but it is still pension-leaning, not investment-friendly by default.

They also allow US visitors up to 180 days visa-free as tourists, which makes planning easier while you prepare a residency application.

Why it’s popular: predictable residency pathway + strong retiree benefits.

2. Costa Rica: Pensionado / Rentista

Status: Active in 2026

Pensionado: ~$1,000/month lifetime income

Rentista: higher income or deposit

401(k): usually not ideal unless structured

Costa Rica remains stable but is less flexible for pure retirement-account drawdowns.

Their tourist stays for many travelers (including US citizens) are often up to 180 days, but the immigration officer sets the exact number on entry.

Why it’s chosen: stable governance, good healthcare, clear residency tracks.

3. Ecuador: Retirement / Independent Income

Status: Active in 2026 (thresholds tied to minimum wage)

Accepts: SS, pensions, investment and retirement income

401(k): commonly accepted if documented

Ecuador is one of the most forgiving systems for mixed income streams.

Their tourist allowance for US visitors is generally 90 days in a 12-month period.

Why it works: low cost of living, accessible cities, and SS/SSDI-friendly residency options.

4. Philippines: SRRV (Special Resident Retiree’s Visa)

Status: Active in 2026

Accepts: Proof of lifetime pension $800/month single / $1,000 with dependents for the pensioner route. SRRV is primarily described around pensions plus deposit categories.

401(k): Withdrawals aren’t typically the “headline” qualifier, but stable income and deposits are central.

Why it’s chosen: English usage, affordability, strong veteran communities.

5. Mexico: Temporary Resident (No Work)

Status: Active in 2026 (consulate-specific)

Accepts: pensions, SS, 401(k)/IRA withdrawals, savings

Key risk: income thresholds vary by consulate

Mexico remains accessible, but applicants must choose consulates carefully.

They have a visitor permit (FMM) with a maximum validity of 180 days, but 180 days is not guaranteed - it can be less at the officer’s discretion.

Why it’s chosen: proximity to the US, strong expat infrastructure, cost flexibility.

6. Portugal: D7 Passive Income Visa

Status: Active in 2026

Income benchmark tied to minimum wage (updated yearly)

Accepts: pensions, investments, retirement withdrawals

401(k): well-supported if consistent

Portugal remains one of the best fits for investment-based retirees.

Their D7 is tied to income thresholds based on minimum wage and household size. Common guidance is roughly “minimum wage for the main applicant + 50% spouse + 30% per dependent” (figures change over time).

Portugal is also in Schengen (see Schengen rules below).

Why it’s chosen: long-term stability, healthcare, and a clear residency-to-citizenship pathway.

7. Thailand: Retirement & Long-Stay Options

Status: Active in 2026

Multiple routes (bank balance, income, mixed)

401(k): accepted if monthly deposits are provable

Thailand remains accessible but increasingly documentation-heavy.

Their retirement visa financial requirements commonly include either 800,000 THB in a Thai bank (~$25,800 USD) or 65,000 THB/month income (~$2,100 USD), with specifics depending on the visa type and consulate.

Why it’s chosen: strong private healthcare options and long-established expat systems.

8. Malaysia: MM2H (Multiple tiers)

Status: Active but complex in 2026

Focus on fixed deposits + income

Rules change frequently

This is not a beginner-friendly option, but still viable for higher-asset households.

Their MM2H has had major updates and multiple variants (national programs and special zones), often involving fixed deposits rather than simple monthly income thresholds. Official program pages show fixed-deposit structures for national MM2H tiers.

Why it’s chosen: comfort, healthcare value, affordability (but entry rules can be stringent).

9. Türkiye: Short-Term Residence

Status: Active in 2026

Income assessed as “means of support”

Flexible, case-by-case

Türkiye remains one of the most adaptable systems for non-workers.

Their official immigration site lists residence permit categories, and applicants commonly need to show financial capacity and health insurance depending on permit type.

Why it’s chosen: big-city amenities, affordability, and flexible residency pathways.

10. Uruguay: Residency with Proof of Income

Status: Active in 2026

No hard public minimum

Interview-based assessment

Uruguay favors stability over income optimization.

They tend to focus on proof of stable monthly income (like a pension) rather than a single posted universal minimum, and requirements can vary by case.

Why it’s chosen: calm lifestyle, stability, and long-term “settle” vibes.

Country-to-country visa hopping routes (practical + legal)

These routes are for people who are:

doing short-term stays while preparing paperwork (apostilles, background checks, proof of income), or

waiting on appointment windows / consulate processing, or

testing locations before committing.

Rule #1: Schengen is a hard limit

For most non-EU travelers, Schengen is 90 days in any 180-day period total across Schengen countries.

That means you can’t “reset” by crossing from Portugal to Spain - it’s still Schengen time.

Route Set A: Latin America “low friction” loop (tourist stays)

Best for: people easing out of the US, staying near the Americas, and testing 2–4 countries.

Example loop (safe pacing):

Panama (up to 180 days visa-free for US tourists)

Costa Rica (often up to 180 days; days granted set on entry)

Mexico (up to 180 max on FMM, but not guaranteed)

Optional short test trip elsewhere, then return to whichever residency process you’re pursuing.

Why this works: you can structure your year around long tourist stamps while you build a residency file.

Reality check: Mexico can be unpredictable on entry lengths now (some travelers are issued fewer than 180). Plan with buffer days.

Route Set B: “Portugal + non-Schengen reset” for Europe

Best for: people aiming for Portugal (D7) but needing legal time while documents process.

The core rule:

Spend time in Schengen (including Portugal) up to 90/180, then spend time outside Schengen until you have enough days available again.

Practical two-country rhythm:

Portugal (Schengen) → then Türkiye (non-Schengen) → then back to Portugal once days roll forward.

Portugal (Schengen) → then either Morocco, Tunisia, Egypt, Serbia, Bosnia and Herzegovina, Montenegro, Albania, U.K., or even Ireland → then back to Portugal once days roll forward.

This is simple, affordable, and avoids “oops I overstayed Schengen.”

Bonus tip: With the EU rolling out more automated entry/exit tracking systems, Schengen overstays are likely to be caught more consistently.

If you’re waiting on a Portuguese D7 or managing Schengen time, the safest approach is a clean non-Schengen reset. Popular options include Türkiye, Morocco, Serbia, Albania, and Montenegro - each offering visa-free stays without touching your Schengen allowance.

Route Set C: Southeast Asia “medical + affordability” loop (for scouting)

Best for: people comparing healthcare quality and daily living costs in multiple countries before picking a retirement visa.

Example scouting loop:

Malaysia (scout healthcare + housing; MM2H rules vary)

Thailand (evaluate retirement visa pathway if 50+)

Philippines (compare SRRV options + English accessibility)

Important: Tourist entry lengths in SE Asia change more often than the Americas, so for hopping logistics you’ll want to confirm current stay lengths right before you fly.

Study something fun - learn to cook tamales or other cuisines!

Can people use Student Visas instead?

Yes, but only if they understand the tradeoffs.

Student visas are not loopholes, but they are legitimate residence paths when retiree visas don’t fit. If someone has steady income (SS/SSDI/VA, pension, 401k draw), student visas can be an easier path into countries that don’t have retiree/passive-income visas.

What student visas usually require

proof of enrollment (language school, university, accredited program)

proof of funds / means of subsistence

health insurance

clean background (sometimes)

What student visas usually allow

legal residence

long stays (6–24 months)

access to healthcare systems (varies)

proof-of-funds based approval

What they usually do not allow

unrestricted work (sometimes “no work,” sometimes limited hours)

skipping classes

permanent status by default

trying to use it as a pure loophole without studying (high denial risk)

In Europe: a long-stay/national student visa lets you live in that country, but travel around Schengen still typically follows the 90/180 rule outside the issuing country (example: France explains this; Italy also notes 90/180 travel outside the host country).

Who student visas work best for

people under retirement age

people with income but no “pension”

people needing time and legal footing while you build long-term options

people who can attend language or degree programs

people who want healthcare access that comes with residency status (some countries)

Common student-visa countries

Portugal

Spain

France

Mexico

Germany

Japan

For many people on 401(k) income, student visas function as a bridge, not a final destination.

The honest bottom line (for regular people)

Yes, people on SS, SSDI, VA, pensions, 401(k)s, and investment income can move abroad in 2026

No, not every visa treats all income equally

Yes, student visas can expand options but they are not “free passes”

The safest path is matching your income type to the right visa category

This is not about escaping rules.

It’s about using the rules that already exist.

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Tech Elevator Demystified: Reviews, Legitimacy, and Winning Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008329038-96GH4TTYZATP6N3WDWXR/tech_elevator.png)

![Cracking the Code: Coding Dojo Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707007756149-VSJNN2PHHX2RWK6RSVQM/coding_dojo.png)

![App Academy Unveiled: Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008090320-IUIIV4T416FP5ILRGK5W/app_academy.png)

![CareerFoundry Decoded: Reviews, Legitimacy, and the Best Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008030234-CZTE1805JUCU2M2GK7RO/careerfoundry.png)