Silver Mines: Key Considerations for Retail Investors in Precious Metals

1 oz Silver Coin - Australian Kookaburra mint condition, Perth

Remote Jobs > Online Businesses > Investment Income > Silver Mines: Key Considerations for Retail Investors in Precious Metals

Understanding Silver Mines: A Comprehensive Guide for Retail Investors

Silver has long been a valuable commodity, serving both industrial and investment purposes. As one of the most sought-after precious metals in the world, silver plays an essential role in various industries, from electronics to renewable energy. For investors, silver mines present a unique opportunity to gain exposure to this versatile metal, especially during periods of economic uncertainty.

Silver’s ability to act as a hedge against inflation and currency depreciation has made it a popular asset among investors, particularly those looking to diversify their portfolios. This is especially true in countries like the United States, where many corporate investors are drawn to the dual function of silver as both an industrial resource and a financial safe haven. As demand for silver continues to grow across industries such as technology and energy, understanding how to invest in silver mines has become increasingly crucial.

In this comprehensive guide, you’ll learn about the key factors influencing silver mine investments, including market drivers, risks, and opportunities. Additionally, you’ll discover how silver mining companies operate globally, especially in regions like Australia, which boasts some of the largest silver deposits in the world.

Index of Sections

What Are Silver Mines? Understanding the Basics of Silver Mining

Why Invest in Silver Mines? Advantages of Adding Silver to Your Portfolio

Factors Influencing Silver Mine Investments: Key Market Drivers

Top Global Silver Mining Companies to Watch

Evaluating Silver Mining Stocks: Metrics Retail Investors Should Know

Risks and Challenges of Investing in Silver Mines

Silver Mining and Environmental Impact: What Investors Need to Consider

How to Diversify Your Precious Metals Portfolio with Silver Mines

Silver Mines vs. Silver ETFs: Which is Right for You?

Future Outlook: Trends Shaping the Silver Mining Industry

Accessing the Latest Silver Market Information Online

Silver Mines: A Strategic Investment for the Future

What Are Silver Mines? Understanding the Basics of Silver Mining

Silver mining has been around for centuries, with significant contributions from countries like Mexico, Peru, and the United States. Today, silver is mined through two primary methods: open-pit mining and underground mining. The method used depends on the depth and concentration of silver deposits within the Earth.

Open-pit mining involves removing large quantities of surface material to access silver deposits near the Earth's surface. This method is often preferred when silver is found in large quantities but at shallow depths.

Underground mining requires creating tunnels and shafts to access deeper silver veins. This method is generally more expensive due to the complexity of accessing and extracting the ore from deep within the ground.

Once the silver-containing ore is extracted, it undergoes a series of processes to isolate the metal. These include crushing (also known as comminution), which breaks the ore into smaller pieces, and froth flotation, where chemicals are used to separate silver from other metals like lead and zinc. In many cases, silver is extracted as a byproduct of mining these other metals.

In terms of production scale, modern silver mines are capable of producing millions of ounces of silver annually. For instance, the largest silver-producing mines in the world, such as Mexico’s Penasquito mine and Australia’s Cannington mine, yield 20 million and 10 million ounces of silver respectively each year. In 2022, global silver production reached approximately 880 million ounces, with Mexico, Peru, China, and the United States leading the charge.

The processes used to refine silver after extraction vary depending on the ore's purity. Common methods include cyanide leaching, smelting, and electrolytic refining. Each method is designed to isolate silver to its purest form—usually 99.9% purity or higher—before it is sold to various industrial and investment markets.

As you explore investing in silver mines, it’s essential to understand the nuances of mining operations and how silver moves from raw ore to refined metal. By doing so, you can make more informed decisions about where and how to allocate your investments.

Why Invest in Silver Mines? Advantages of Adding Silver to Your Portfolio

Silver offers several advantages as an investment, particularly when accessed through silver mining companies. Here are the primary reasons why adding silver mines to your portfolio can be beneficial:

Hedge Against Economic Uncertainty

Silver’s value tends to rise during periods of economic instability, such as inflationary periods, recessions, or global financial crises. Similar to gold, silver is often seen as a "safe-haven" asset. This is especially true in markets like the United States, where investors seek to protect their wealth from fluctuations in fiat currency.

Diversification Benefits

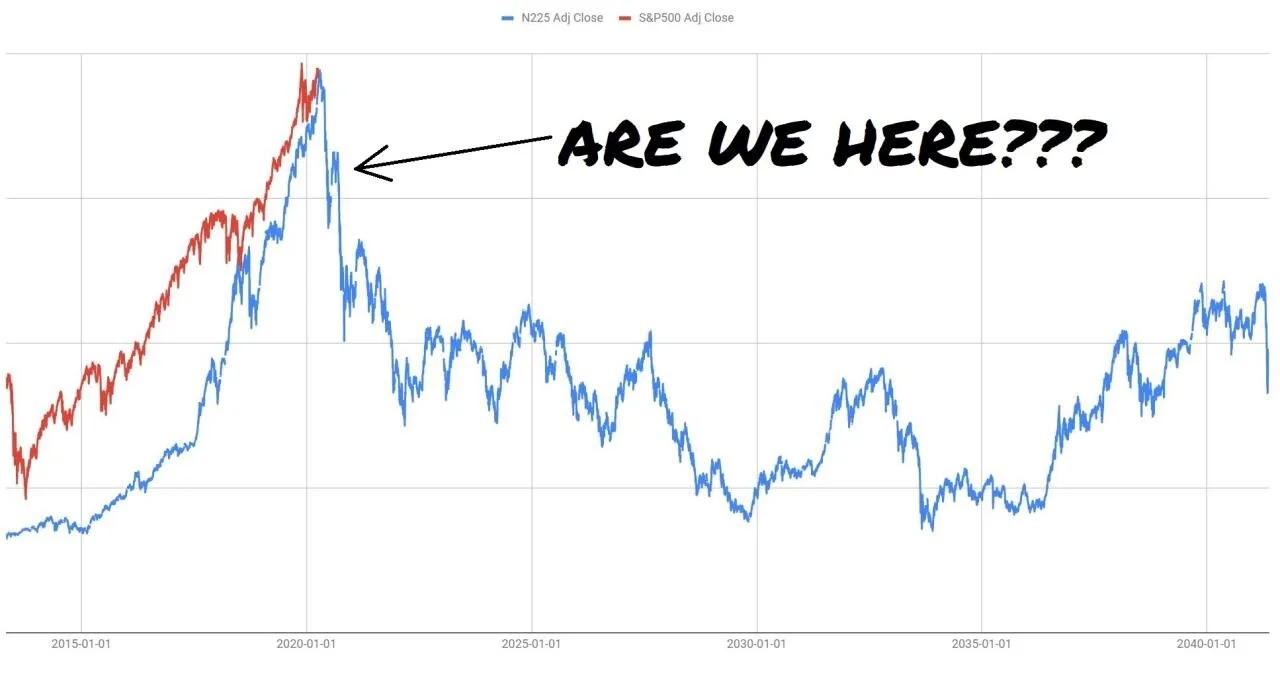

Silver is a non-correlated asset, meaning its price movements are not directly tied to traditional assets like stocks and bonds. By investing in silver mining companies, you can diversify your investment portfolio and reduce overall risk. This is particularly useful in times of market volatility when stocks may underperform but commodities like silver rise in value.

Rising Industrial Demand

Silver is unique among precious metals because of its wide range of industrial applications. It is used extensively in electronics, medical equipment, and renewable energy technologies, especially solar panels. The growing demand for silver in industrial sectors will likely continue to drive its price higher in the coming decades. Experts predict that silver demand could exceed supply in the near future, which would further boost its price.

Additionally, silver is a critical component in the automotive industry, especially as electric vehicles become more popular. With major car manufacturers ramping up production of electric vehicles, the demand for silver in batteries and charging systems is expected to skyrocket. In 2023, the silver market saw substantial growth driven by this industrial demand, and the trend is likely to continue.

Exposure to Silver Prices and Leverage

Investing in silver mines provides a unique opportunity to gain leveraged exposure to silver prices. This means that when silver prices rise, the stock prices of silver mining companies tend to rise even more. This leverage offers the potential for higher returns, although it also comes with increased risk.

For example, when the price of silver increased by 20% in 2020, the stock prices of some silver mining companies saw gains of over 100%. This leveraged exposure can significantly enhance your portfolio’s performance, especially during bull markets for silver.

Geopolitical and Economic Factors

Geopolitical events, inflationary pressures, and currency fluctuations also play a major role in silver prices. In times of uncertainty, such as during trade tensions or periods of high inflation, silver becomes a go-to asset for investors seeking stability. Additionally, silver prices are influenced by central bank policies, especially in major economies like the United States.

In addition, corporate investors are increasingly turning to silver as a way to diversify their holdings and reduce risk. As global economic tensions rise, companies are seeking ways to protect their corporate assets from volatility in traditional financial markets.

In summary, silver mines present several advantages for investors seeking to hedge against economic uncertainty, diversify their portfolios, and gain exposure to an essential industrial metal. Understanding these advantages will help you make more informed decisions as you evaluate silver mining investments.

Factors Influencing Silver Mine Investments: Key Market Drivers

Investing in silver mines is driven by several key market factors. Understanding these drivers helps investors make informed decisions and better predict the performance of silver mining stocks. Here are the most influential factors to consider when evaluating silver mine investments:

Commodity Prices

Silver prices fluctuate based on various factors, including supply and demand, production costs, and global economic conditions. When silver prices rise, companies with lower production costs can see significant stock price increases. Monitoring the commodity price of silver is essential to understanding the potential profitability of mining operations.

Silver’s price is influenced by the global commodity market, where the supply of silver sometimes cannot meet the increasing demand. For example, global silver supply fell short of demand in 2023 by over 184 million ounces, which contributed to higher silver prices. This imbalance between supply and demand is often a major driver for both the commodity price and the performance of silver mining companies.

Additionally, silver prices are closely tied to other metals, like gold, zinc, and lead, since silver is often produced as a byproduct of mining these metals. Changes in the prices of these companion metals can also influence the profitability of silver mines.

Industrial Demand

Silver’s use in industries such as electronics, medical devices, and renewable energy is expected to continue growing, driving demand for the metal. In particular, the demand for silver in solar panel production has surged in recent years as the world transitions to renewable energy. By 2050, it is estimated that solar energy production could account for up to 50% of global silver consumption, which would amount to hundreds of million ounces annually.

The automotive industry is another key driver of silver demand, especially as electric vehicles (EVs) gain traction. Each EV requires a significant amount of silver for batteries, wiring, and charging infrastructure. As more governments and companies worldwide push for clean energy and electric mobility, demand for silver in this sector is likely to rise dramatically.

Technological Advancements

Technological innovations also play a crucial role in influencing silver mine investments. For example, the development of solid-state batteries by companies like Samsung, which use silver as a key component, is expected to increase silver consumption in the future. These batteries, which are lighter and more efficient than traditional lithium-ion batteries, could revolutionize the EV market and significantly boost demand for silver.

Advancements in mining technology have also improved the efficiency of silver extraction. Modern mining equipment and data-driven mining techniques allow for more precise extraction of silver, reducing waste and increasing profitability.

Geopolitical and Economic Factors

Silver prices are sensitive to global geopolitical events and macroeconomic factors. For example, trade tensions between major economies, like the United States and China, can lead to increased demand for safe-haven assets like silver. Similarly, inflationary pressures and currency devaluations tend to push up the price of silver as investors seek to protect their wealth from declining fiat currencies.

Central bank policies, particularly in major economies like the United States, also play a significant role in influencing silver prices. When central banks cut interest rates or engage in quantitative easing, silver prices often rise, as these policies reduce the value of fiat currency and increase demand for alternative stores of value.

In addition to geopolitical factors, silver prices are also affected by local conditions in the countries where mines operate. For example, changes in government regulations, tax policies, and labor laws in major mining countries can impact the profitability of silver mining companies.

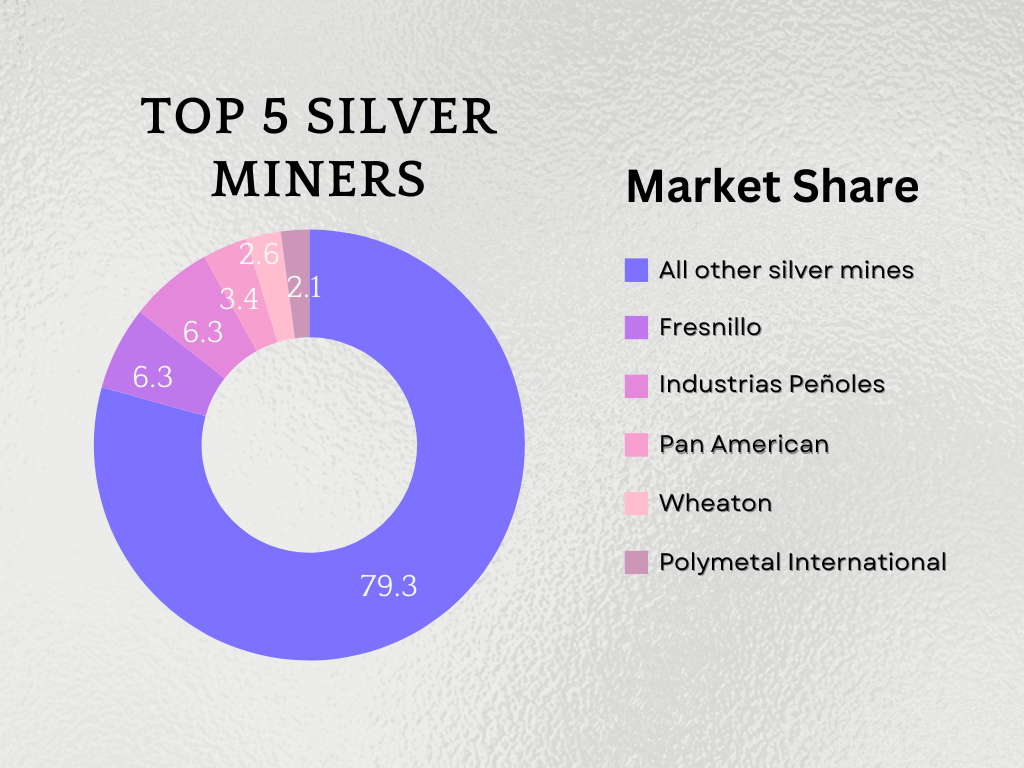

Top Global Silver Mining Companies to Watch

For investors interested in silver mining, it’s essential to know which companies are the top players in the market. Here is an overview of some of the most prominent silver mining companies worldwide:

1. Industrias Penoles SAB de CV (IPOAF)

Revenue: $5.6 billion

Location: Mexico

As one of the largest silver producers in the world, Industrias Penoles operates major silver and lead mines in Mexico. It has been a key player in the mining industry for decades and is known for its vast reserves of silver, zinc, and lead. With a workforce of over 20,000 employees, the company uses cutting-edge mining technologies to optimize productivity and efficiency.

2. Polymetal International (AUCOY)

Revenue: $2.7 billion

Location: Kazakhstan

Polymetal International is a leading precious metals mining company with operations across Russia and Kazakhstan. The company focuses on producing silver and gold and has a portfolio of nine mines. It employs around 12,000 workers and continues to invest in advanced mining technologies to improve efficiency and sustainability.

3. Fresnillo

Revenue: $2.50 billion

Location: Mexico

Fresnillo operates three major silver mines in Mexico: Fresnillo, Saucito, and Cienegas. Its largest mine, Fresnillo, produced 675,960 tonnes of ore in 2022. The company is known for its commitment to environmental sustainability and uses underground communication systems and automated hauling trucks to reduce the environmental impact of its operations.

4. Pan American Silver

Revenue: $1.5 billion

Location: Canada

Pan American Silver operates across Latin America, including Mexico, Peru, and Bolivia. In 2022, the company processed 28.3 million ounces of silver, making it one of the largest silver producers in the world. The company is recognized for its use of modern mining methods and its focus on sustainability, particularly in water management and environmental stewardship.

5. Wheaton Precious Metals

Revenue: $1.1 billion

Location: Canada

Wheaton Precious Metals is a precious metals streaming company that provides upfront payments to miners for the right to purchase future metal production. Wheaton has agreements with 23 operating mines and nine development-stage projects. This business model allows it to benefit from silver and gold production without the high capital costs of owning and operating mines.

Evaluating Silver Mining Stocks: Metrics Retail Investors Should Know

Before diving into silver mining stocks, retail investors must understand the key metrics used to evaluate these companies. Here are the most important factors to consider when assessing silver mining stocks:

Resource Potential

Resource potential refers to the total amount of silver, lead, zinc, gold, and other metals that a mining company can extract from its deposits. Investors need to evaluate both the quantity and quality of these resources. A large deposit with low-grade silver may be less valuable than a smaller deposit with high-grade silver.

Measured, Indicated, and Inferred Resources are terms commonly used in mining to classify the certainty of resource estimates. Measured resources are the most certain, followed by indicated and then inferred resources. Understanding these classifications is crucial for investors who want to assess the likelihood of a mining project being economically viable.

Production Outlook

A mining company's production outlook refers to its expected silver output over the life of the mine. The more silver a company can produce at a low cost, the more profitable it is likely to be. Investors should review Preliminary Economic Assessments (PEAs), Pre-Feasibility Studies (PFS), and Feasibility Studies (FS) to understand a company's projected production rates.

For example, in 2022, Wheaton Precious Metals entered into new agreements that are expected to add significant future production capacity, further increasing its leverage to rising silver prices.

All-In Sustaining Costs (AISC)

AISC is a crucial metric for evaluating the cost-efficiency of a mining operation. This metric includes all of the costs required to produce an ounce of silver, from mining to refining. Lower AISC means higher profitability, especially when silver prices rise.

For instance, Pan American Silver has consistently maintained lower-than-average AISC, which allows it to remain profitable even when silver prices are low. By investing in companies with low AISC, investors can minimize their downside risk while maximizing potential returns.

Net Asset Value (NAV)

NAV is a key financial metric used to estimate the total value of a mining company’s assets. NAV takes into account the value of the company’s mining projects and subtracts its liabilities. Investors should focus on NAV per share, as this allows for better comparison across different companies.

When silver prices rise, NAV tends to increase due to the leveraged nature of mining companies. Companies like Industrias Penoles often see large NAV increases during silver bull markets, making them attractive investments.

Discounted Cash Flow (DCF)

A DCF model is used to estimate the future cash flow that a mining company’s projects will generate, discounted to the present value. This model provides a comprehensive view of a company’s future profitability and is commonly used for development-stage mining companies that have not yet begun production.

Investors should review the DCF models in Feasibility Studies to better understand a company’s long-term potential. For example, companies like Boab Metals have released DCF models that provide insight into their future profitability as they move closer to production.

Risks and Challenges of Investing in Silver Mines

While investing in silver mines offers significant opportunities, it also comes with certain risks and challenges. Understanding these risks is crucial for making informed decisions. Here are the key risks associated with silver mining investments:

Declining Ore Grades

As with many mining industries, silver mines are facing the challenge of declining ore grades. Over time, the highest-quality and most accessible ore is depleted, leaving mining companies to extract lower-grade ore, which can be more expensive and difficult to process. This not only affects the profitability of silver mines but also requires more advanced technologies and higher capital investment to maintain production levels.

For example, several silver mines in the United States have reported decreasing ore grades, which has impacted their profitability. Companies must continually adapt to these challenges through technological innovations and cost-cutting measures to stay competitive in the market.

Political Instability and Geopolitical Risk

Political instability is a significant risk for silver mines, particularly for companies operating in countries with less stable governments. Changes in government regulations, tax policies, and environmental laws can have a dramatic impact on mining operations. In some cases, entire mines may be nationalized or forced to close due to political conflicts or environmental protests.

While countries like Australia and the United States have relatively stable political environments for mining, other regions, such as South America and parts of Africa, present higher risks. Investors must assess the political stability of the countries where silver mines operate before making investment decisions.

Environmental and Social Risks

Silver mining can have significant environmental impacts, including deforestation, water contamination, and loss of biodiversity. As the world becomes more environmentally conscious, mining companies are under increasing pressure to adopt sustainable practices. Failure to comply with environmental regulations can result in costly fines, legal battles, and even the closure of mines.

For example, the Cannington mine in Australia has implemented strict environmental management programs to reduce its ecological footprint, ensuring compliance with global environmental standards. However, not all companies are as proactive, and investors should evaluate each company’s environmental record before investing.

In addition to environmental concerns, social risks are also a factor. Silver mines, especially in developing countries, may face opposition from local communities due to concerns over labor conditions, land use, and environmental degradation. These social tensions can delay or halt mining operations and pose reputational risks for the companies involved.

Volatility in Silver Prices

Silver prices are notoriously volatile, often experiencing large fluctuations in short periods. These price swings can be caused by various factors, including changes in industrial demand, currency fluctuations, and geopolitical events. As a result, the profitability of silver mining companies can be difficult to predict.

For instance, in 2020, silver prices saw a dramatic increase due to investor demand during the COVID-19 pandemic, only to drop significantly as the global economy began to recover. Investors in silver mines need to be prepared for this volatility and understand how it can affect their returns.

Silver Mining and Environmental Impact: What Investors Need to Consider

Environmental concerns are becoming a central issue for the mining industry, and silver mining is no exception. As global demand for silver continues to rise, companies are under increasing pressure to adopt sustainable mining practices and minimize their environmental impact. Here’s what investors need to know about the environmental impact of silver mining:

Energy Consumption and Carbon Emissions

Mining is an energy-intensive industry, and silver mines often rely on fossil fuels to power their operations. However, many companies are transitioning to renewable energy sources, such as solar and hydroelectric power, to reduce their carbon emissions. For example, Boab Metals has committed to using hydroelectric power for its mining operations, significantly reducing its environmental footprint.

Additionally, mining companies are investing in more energy-efficient machinery and processes to lower their overall energy consumption. These efforts not only benefit the environment but can also lead to cost savings, making the mines more profitable in the long run.

Water Usage and Contamination

Water is a critical resource in silver mining, used in the extraction and refining processes. However, improper water management can lead to contamination of local water supplies, harming ecosystems and nearby communities. Many silver mining companies have implemented water recycling and treatment systems to mitigate the environmental impact of their water usage.

In regions like Australia and the United States, where water scarcity is an issue, sustainable water management practices are particularly important. Mining companies that fail to manage their water usage responsibly may face regulatory fines, community opposition, and reputational damage.

Waste Management

Silver mining generates large amounts of waste, including tailings (the materials left over after silver extraction). If not managed properly, these tailings can release harmful chemicals into the environment, posing risks to both human health and wildlife. As a result, silver mines are required to implement strict waste management protocols to prevent environmental contamination.

Leading companies in the industry are investing in lined tailings storage facilities and dry stack tailings methods, which help minimize the environmental risks associated with mining waste. Investors should assess each mining company’s waste management practices to ensure they meet global environmental standards.

Social Responsibility and ESG (Environmental, Social, and Governance) Factors

In addition to environmental concerns, social responsibility has become an increasingly important factor for investors. Companies that prioritize the welfare of their workers, support local communities, and engage in ethical business practices are more likely to attract responsible investors.

Environmental, Social, and Governance (ESG) criteria have become a standard measure for evaluating companies across various industries, including mining. Companies with strong ESG practices tend to outperform those that do not prioritize sustainability, making ESG a crucial consideration for long-term investors.

For example, companies that invest in community development programs and maintain positive relationships with local stakeholders are more likely to avoid conflicts and disruptions in their operations. ESG considerations are also becoming more important for corporate investors, who are increasingly looking for ethical and sustainable investment opportunities.

How to Diversify Your Precious Metals Portfolio with Silver Mines

Investing in silver mines is a great way to diversify a precious metals portfolio, but it’s essential to do so strategically. Diversification helps mitigate risk by spreading investments across different asset types, reducing exposure to market volatility in any single asset. Here are some strategies to effectively diversify your precious metals portfolio with silver mines:

Physical Silver vs. Silver Mining Stocks

Investors can choose between investing in physical silver or silver mining stocks, each of which offers different benefits and risks. Physical silver, in the form of coins or bullion, provides a direct investment in the metal itself and can serve as a hedge against inflation. It’s often viewed as a safe-haven asset, particularly during times of economic uncertainty or currency devaluation.

On the other hand, silver mining stocks provide leveraged exposure to the price of silver. This means that when silver prices rise, mining stocks tend to increase by a larger percentage, offering the potential for higher returns. However, mining stocks also carry more risk, as they are influenced by factors such as production costs, geopolitical risk, and company management.

Silver ETFs

Exchange-Traded Funds (ETFs) that focus on silver mining companies offer another way to gain diversified exposure to the silver market. ETFs provide investors with the opportunity to invest in a basket of silver mining stocks without having to pick individual companies. This can help spread risk across multiple mining operations and countries.

Popular silver mining ETFs include the Global X Silver Miners ETF (SIL) and the iShares MSCI Global Silver Miners ETF (SLVP). These funds invest in a wide range of silver mining companies, providing exposure to both major producers and junior mining companies.

Junior Mining Companies vs. Major Producers

Investors should also consider diversifying their holdings between junior mining companies and major producers. Junior miners are smaller companies focused on exploring and developing new silver deposits. These companies often offer higher risk but also higher potential rewards, as successful exploration projects can lead to substantial increases in stock value.

In contrast, major producers like Fresnillo and Pan American Silver are well-established companies with consistent production levels. These companies tend to be less risky, as they generate steady cash flow from their existing mines. By holding a mix of junior miners and major producers, investors can balance the potential for high returns with the stability of established companies.

Geographic Diversification

Geographic diversification is another important consideration when investing in silver mines. Mining operations are subject to different risks depending on the country in which they operate, including political instability, environmental regulations, and labor laws. By investing in mines across multiple countries, investors can reduce the risk of being affected by adverse conditions in any one region.

For example, an investor may choose to allocate part of their portfolio to mines in Australia, known for its stable political environment and vast silver resources, while also investing in mines in Mexico and the United States. This approach provides exposure to different markets and reduces geographic risk.

Adding Gold and Other Precious Metals

While silver is an important component of any precious metals portfolio, it’s also wise to diversify into other metals like gold, platinum, and palladium. Each metal has its own unique market dynamics, and holding a mix of metals can help mitigate the risks associated with any one market.

Gold, for example, is often viewed as a store of value and performs well during times of economic uncertainty. Platinum and palladium are used primarily in industrial applications, such as automotive manufacturing, and may provide additional upside as global demand for these metals increases.

Image of silver bars from Boab Metals.

Silver Mines vs. Silver ETFs: Which is Right for You?

When it comes to investing in silver, you have several options: physical silver, silver mining stocks, and Silver ETFs. Each of these investment vehicles offers distinct advantages and risks, and choosing the right one depends on your financial goals and risk tolerance. Here's a breakdown of the key differences between silver mines and Silver ETFs:

Silver Mining Stocks

Investing directly in silver mining stocks provides leveraged exposure to the price of silver. This means that when silver prices rise, mining stocks often rise more dramatically, offering the potential for higher returns. However, this leverage also means that mining stocks are more volatile and carry higher risk than physical silver or ETFs.

Advantages: Potential for high returns, leveraged exposure to silver prices, and the ability to invest in individual companies.

Disadvantages: Higher risk, especially with junior mining companies, which may not yet have established production levels. Mining companies are also subject to geopolitical, environmental, and operational risks.

Silver ETFs

Silver ETFs offer a more diversified approach to investing in silver. ETFs invest in a basket of silver mining stocks, allowing investors to gain exposure to the silver market without having to pick individual companies. This diversification can help reduce risk while still providing exposure to the silver mining industry.

Advantages: Diversified exposure to multiple companies, lower risk than individual mining stocks, and easy to trade like a stock. ETFs are also more liquid than physical silver.

Disadvantages: Lower potential for returns compared to individual mining stocks. Additionally, ETFs charge management fees, which can slightly reduce overall returns.

Physical Silver

While not directly related to mining companies, physical silver is another option for investors. Holding silver bullion or coins provides a direct investment in the metal itself, without the risks associated with mining operations or company management. However, physical silver requires storage and can be less liquid than stocks or ETFs.

Advantages: Direct ownership of silver, no exposure to company-specific risks, and acts as a hedge against inflation and currency devaluation.

Disadvantages: Requires storage, can be difficult to sell quickly, and does not provide any income or dividends.

Future Outlook: Trends Shaping the Silver Mining Industry

The future of silver mining looks promising, with several key trends expected to drive demand and influence investment opportunities in the coming decades. Here are the major trends shaping the silver mining industry:

Rising Industrial Demand

Silver’s use in industrial applications, particularly in renewable energy and electric vehicles, is expected to continue growing. By 2050, it’s estimated that up to 50% of silver demand will come from the solar panel industry alone. This demand is being driven by the global push for clean energy, as solar panels require large amounts of silver for their photovoltaic cells.

Additionally, the electric vehicle (EV) market is growing rapidly, with major car manufacturers like Tesla and Volkswagen ramping up production. EVs use silver in their batteries, wiring, and charging infrastructure, and as the world transitions to electric transportation, the demand for silver is expected to skyrocket.

Supply Constraints

Despite the growing demand for silver, the global supply of silver is under pressure. Several major silver mines have reported declining ore grades, and new silver discoveries are becoming increasingly rare. This supply constraint, combined with rising industrial demand, is expected to drive silver prices higher in the coming years.

In 2024, global silver production is expected to grow by 4.1%, reaching over 916 million ounces. However, production is expected to decline after 2030 as existing mines become depleted and fewer new deposits are discovered.

Technological Advancements

Advances in mining technology are helping companies extract silver more efficiently and reduce costs. Automation, data analytics, and AI-driven technologies are being integrated into mining operations, allowing companies to identify new resources and optimize production. These technologies are especially important as companies face declining ore grades and more difficult mining conditions.

For example, several mining companies are using AI to analyze geological data and identify new drilling targets. This technology can significantly reduce the time and cost of exploration, making it easier to discover new silver deposits.

Sustainable Mining Practices

As environmental concerns grow, silver mining companies are under increasing pressure to adopt sustainable practices. Many companies are transitioning to renewable energy sources, such as solar and hydroelectric power, to reduce their carbon footprint. Additionally, companies are investing in water recycling and tailings management to minimize the environmental impact of their operations.

Companies that prioritize Environmental, Social, and Governance (ESG) factors are more likely to attract investors who value sustainability. For example, Boab Metals has committed to using hydroelectric power for its mining operations, a move that has been well-received by environmentally conscious investors.

Global Geopolitical Dynamics

Geopolitical factors will continue to play a significant role in the silver mining industry. Trade tensions between major economies, such as the United States and China, can lead to fluctuations in silver prices. Additionally, changes in government regulations, especially in countries with significant silver reserves like Mexico, Peru, and Australia, can impact the profitability of mining operations.

Countries like the United States and Australia are seen as more stable environments for mining operations due to their well-established legal frameworks and mining-friendly policies.

The Northern Australia Infrastructure Fund is an example of the mining-friendly policies in Northern Australia.

Boab Metals is at the due diligence stage of the fund process, the video below explains the fund process in detail.

However, regions like South America and Africa may pose higher geopolitical risks due to political instability and regulatory uncertainty.

Investment Opportunities

For investors, the future of silver mining offers a range of opportunities. As the demand for silver continues to grow, well-established mining companies with strong production capabilities are likely to benefit. However, junior mining companies that are exploring new deposits also present high-risk, high-reward opportunities for investors willing to take on more risk.

Investors should also consider Silver ETFs, which provide diversified exposure to the silver mining industry and help reduce the risks associated with investing in individual companies. ETFs like the Global X Silver Miners ETF and iShares MSCI Global Silver Miners ETF offer exposure to a wide range of mining companies, from major producers to junior explorers.

Accessing the Latest Silver Market Information Online

In today’s digital age, staying updated with the latest information on silver markets and mines of silver has never been easier. Many investors rely on online resources to get real-time news about silver prices, trends, and investment opportunities. Whether you're placing an order for physical silver or researching the first major silver discovery of the year, having access to timely data is crucial.

Several platforms provide in-depth analysis and insights into the mines of silver, often using visual tools like charts and graphs, where each color represents different metrics such as supply levels or price changes over time.

For those seeking a dedicated room for discussion or expert opinions, many online forums and investor communities offer a place to exchange ideas and strategies. Just be sure to verify that the sources you use for market updates are reputable and have all rights reserved for their content.

Whether you are a seasoned investor or new to the silver market, leveraging online tools will help you make informed decisions and stay updated on changes in the silver industry and mines of silver around the world.

Silver Mines: A Strategic Investment for the Future

Silver remains a valuable asset for investors, offering a hedge against economic uncertainty and exposure to rising industrial demand. Investing in silver mines presents an opportunity for leveraged returns, but it also comes with risks related to market volatility, environmental concerns, and geopolitical factors.

As global demand for silver continues to grow, particularly in the renewable energy and electric vehicle sectors, the future of silver mining looks promising. By understanding the key factors that influence silver mine investments, such as commodity prices, technological advancements, and environmental considerations, investors can make more informed decisions and build a diversified portfolio.

Whether you choose to invest in silver mining stocks, Silver ETFs, or physical silver, it’s essential to evaluate each option’s risk and reward profile carefully. As with any investment, due diligence and a long-term perspective are key to success in the silver market.

Ready to invest in silver? Diversify your portfolio by investing in silver mines in Australia, particularly in Western Australia and the Northern Territory, where government incentives and rising demand create the perfect storm for growth. Alternatively, shop an exclusive collection of minted and cast silver products from leading mints worldwide. Access real-time silver price charts, get detailed information, and capitalize on the dynamic silver price in Australia today.

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website: EatWanderExplore and REmotiFIRE.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Image of silver bars from Boab Metals. Bars say "FINE SILVER, 999.9, NET WT 1000 g, [7 digit number]"](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/36a33d91-5eaa-44cc-aa3e-45889a3d8bc6/boab-silver-bars.png)