Boab Metals: A Silver Investment Opportunity in Australian Mining Companies

Remote Jobs > Online Businesses > Investment Income > Boab Metals: A Silver Investment Opportunity in Australian Mining Companies

Boab Metals - Sorby Hills Project Investment Potential

Imagine investing in a company whose value could soar with the rising demand for one of the world’s most sought-after metals—silver. Now picture a mining project that, with every upward tick in silver prices, delivers substantial gains to its investors. Boab Metals is that company, and the Sorby Hills Project is that opportunity. With potential share prices skyrocketing from $1.93 to over $6.20 per share as silver prices climb, the upside is clear: Boab Metals offers an unprecedented chance to ride the silver wave to remarkable profits.

By Brent Connolly, Geopolitics and Precious Metals Analyst

Index of Sections

Executive Summary: Boab Metals – Sorby Hills Project Investment Potential

Boab Metals: The Next Big Player in Australian Mining

The Sorby Hills Project: A High-Grade Silver Opportunity

Top Reasons Why Investors Are Choosing Boab Metals

Analyzing Boab Metals' Stock Performance and Financials

Inside the Sorby Hills Project: Mining Silver, Lead, and Beyond

Boab Metals: A Promising Investment in the Silver Market

Risks and Opportunities: Navigating the Mining Sector with Boab Metals

How Boab Metals Stacks Up Against Competitors in Global Mining

Boab Metals’ Commitment to Environmental and Social Responsibility

Future Growth: What’s Next for Boab Metals?

A Step-by-Step Guide on How to Invest in Boab Metals

Boab Metals and Australia’s Mining Future: What Retail Investors Should Expect

Why Boab Metals Is the Future of Silver Mining in Australia

Executive Summary: Boab Metals – Sorby Hills Project Investment Potential

Boab Metals Limited is an Australian mining company focused on developing the Sorby Hills Project, a high-grade lead-silver mine located in Western Australia. This executive summary outlines the potential investment opportunities based on the project's financial projections at various silver price levels, highlighting its strong potential for value growth.

The Sorby Hills Project is a significant lead-silver mining development, with a high sensitivity to silver prices. As silver prices fluctuate, so does the value of the project, offering considerable upside potential for investors in a bullish market. The project's core financial metrics—Net Present Value (NPV), forecasted share price, and operating cash flows—illustrate the substantial returns investors could expect under various market conditions for silver.

Boab Metals' Sorby Hills Project was analyzed at four key silver price levels: $30 USD, $50 USD, $75 USD, and $100 USD per ounce. Each price point reveals a significant growth trajectory in both project value and share price:

1. Silver Price: $30 USD per ounce

NPV: AUD 945 million

Forecast Share Price: AUD $1.93

Insight: Even at this relatively low silver price, the project delivers steady cash flow and profitability. The share price of $1.93 reflects moderate growth, appealing to risk-averse investors looking for stable returns.

2. Silver Price: $50 USD per ounce

NPV: AUD 1.548 billion

Forecast Share Price: AUD $3.16

Insight: As silver prices rise, Boab Metals’ project value more than doubles, with a forecast share price of $3.16. This scenario appeals to investors who anticipate a strengthening Australian silver stocks market and seek substantial capital appreciation.

3. Silver Price: $75 USD per ounce

NPV: AUD 2.301 billion

Forecast Share Price: AUD $4.70

Insight: At this price, the project becomes highly profitable, with the share price forecast increasing to $4.70. The large jump in NPV reflects the project’s ability to generate significant returns under favorable market conditions.

4. Silver Price: $100 USD per ounce

NPV: AUD 3.055 billion

Forecast Share Price: AUD $6.24

Insight: In a strong silver market, Boab Metals' Sorby Hills Project delivers exceptional value, with a forecast share price reaching $6.24. Investors stand to benefit from considerable capital growth, making this scenario highly attractive for those anticipating a bullish market for silver.

The Sorby Hills Project benefits from highly efficient operations, with strong operating margins, particularly at higher silver prices. At a silver price of $100 USD per ounce, the project is forecasted to generate AUD 3.4 billion in cumulative cash flow by 2037, highlighting its strong long-term profitability.

For Conservative Investors: At lower silver prices ($30 - $50 USD), the project still provides stable returns, making it a viable investment for those seeking moderate growth in a safe-haven asset.

For Growth-Oriented Investors: At higher silver prices ($75 - $100 USD), Boab Metals presents an exciting opportunity with exponential growth in value and share price, delivering strong returns in a favorable market.

Boab Metals' Sorby Hills Project is an attractive investment opportunity with significant upside potential, particularly in a rising silver price environment. Investors stand to benefit from both steady cash flow and capital appreciation, with the project demonstrating high profitability and enterprise value at all silver price levels. This makes Boab Metals a compelling option for individual investors, whether they are conservative or growth-focused, and those looking for exposure to mining stock opportunities and the precious metals sector.

Investing in critical minerals Boab Metals offers the potential for strong returns, especially if silver prices continue to rise, making it an exciting opportunity for both novice and seasoned investors alike.

Boab Metals: The Next Big Player in Australian Mining

Boab Metals is quickly emerging as one of the most promising names in Australian mines, with a strategic focus on critical resources like silver and lead. As global demand for these metals rises, especially in sectors like renewable energy and industrial manufacturing, Boab Metals is positioning itself to take advantage of lucrative mining stock opportunities within the Australian mining sector.

What sets Boab Metals apart is its flagship project, Sorby Hills, located in the highly favorable mining jurisdiction of Western Australia. This large-scale lead-silver-zinc project gives Boab a competitive edge, boasting high-grade mineral deposits and a clear pathway to production. With a strong leadership team, including Chairman Gary Comb, who has decades of experience in commissioning and operating base metal mines, Boab Metals has all the right ingredients for success in the evolving Australian mining landscape.

While large competitors like Rio Tinto dominate the mining scene, Boab Metals offers a unique investment opportunity due to its smaller size and higher potential for growth. As one of the options for investing in critical minerals suppliers, Boab could play a key role in meeting the increasing global demand for these resources, further boosted by recent government initiatives supporting the exploration and extraction of rare earths and other essential minerals.

The Sorby Hills Project: A High-Grade Silver Opportunity

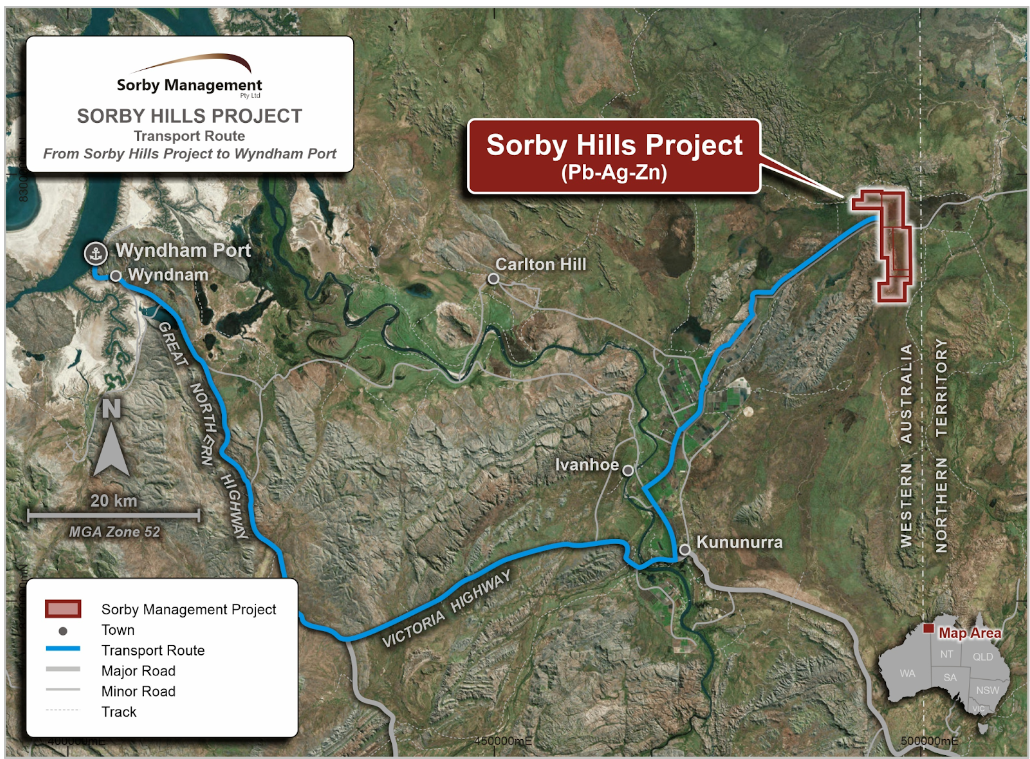

At the heart of Boab Metals' growing reputation is the Sorby Hills Project, a world-class lead-silver-zinc deposit that is among the largest undeveloped silver resources in Australia. Located in Western Australia, Sorby Hills benefits from excellent infrastructure, including proximity to sealed roads, the Wyndham port, and access to skilled labor. This makes it one of the most cost-effective and strategically advantageous silver projects in the country.

What makes Sorby Hills particularly compelling is the JORC-compliant resources that confirm the project's significant economic potential. With more than 47 million tonnes of mineral resources identified, including high-grade silver, lead, and zinc, Sorby Hills has attracted the attention of major financial institutions and retail investors alike.

The project’s environmental approvals and close proximity to infrastructure make it ready for quick development, minimizing the typical risks associated with mining projects. As global demand for silver continues to rise, particularly due to its role in solar energy and electronics, Sorby Hills is perfectly positioned to capitalize on this surge.

For retail investors, Sorby Hills offers an excellent opportunity to gain exposure to the booming silver market while benefiting from the project’s low production costs. With the potential for further resource expansion through ongoing exploration, Sorby Hills could play a major role in Boab Metals’ future growth.

J.P. Morgan, meanwhile, has forecasted that silver prices will average $36 per ounce by 2025, underpinned by ‘strong macro fundamentals and a supportive supply and demand backdrop’”.

- Alexander Jones of International Banker

“Since early 2021 the gold/silver ratio has increased from its long run average of ~70x to 84x today. For silver to maintain its ratio with gold it would need to rally to ~US$37/oz.”

- Andrew Hines of Shaw & Partners

Top Reasons Why Investors Are Choosing Boab Metals

When considering investment in the Australian silver stocks mining sector, Boab Metals presents a unique combination of growth potential, strategic positioning, and financial transparency. Here are the top reasons why investors are flocking to Boab:

Low Entry Cost with High Upside Potential: Boab Metals' stock is still relatively undervalued compared to its larger competitors like Rio Tinto, offering prime mining stock opportunities for investors to enter at an early stage. With significant resources yet to be realized at Sorby Hills, investors can potentially see substantial returns as the project moves into production.

Strong Financial Backing and Sustainability Initiatives: Boab Metals is financially sound, having conducted a FEED study that demonstrates robust economic viability. The company has also made a commitment to sustainable mining practices, securing clean energy agreements with the Ord River Hydroelectric Plant to power its operations.

Global Demand for investing in Critical Minerals: As the world shifts toward greener technologies, the demand for silver and lead is set to skyrocket. These metals are crucial for renewable energy solutions, from solar panels to electric vehicles. By investing in Boab Metals, retail investors can gain direct exposure to this rising demand for critical minerals.

Engagement with Investors: Boab Metals prioritizes transparency with its shareholders, providing regular updates on project milestones and financial performance. This level of communication is a key reason why retail investors feel confident in Boab’s potential for long-term success.

By investing in Boab Metals, you’re not just buying into a company—you’re investing in the future of sustainable mining and the booming silver market. With record silver prices expected in the coming years, Boab Metals is set to be one of the key players in the global mining landscape.

Analyzing Boab Metals' Stock Performance and Financials

Boab Metals’ stock offers a compelling investment opportunity, particularly for those looking to diversify their portfolio with exposure to Australian silver stocks and the silver market. The company's stock performance has been closely tied to the development of its flagship Sorby Hills project, and with the recent completion of a comprehensive Front-End Engineering & Design FEED study, there’s strong potential for growth.

The company’s financial models demonstrate a significant sensitivity to silver prices, meaning the value of the project increases exponentially as the price of silver rises.

Key Takeaways:

Impact of Silver Prices: The enterprise value and share price of Boab Metals grow sharply with rising silver prices. At $30 USD per ounce, the project has a Net Present Value (NPV) of AUD 945 million, with a forecast share price of AUD $1.93. However, as silver prices climb to $100 USD, the NPV rises to AUD 3.05 billion, and the share price soars to AUD $6.24.

Profitability & Strong Returns: The project’s profitability increases significantly across silver price scenarios. At a silver price of $50 USD, the EBITDA rises to AUD 1.586 billion, with a corresponding internal rate of return (IRR) of 59%. These returns continue to grow as silver prices increase, with an impressive IRR of 94% when silver reaches $100 USD per ounce.

Cash Flow Potential: Cash flow generation is particularly strong in high silver price environments. By FY37, the project’s cumulative cash flow is expected to exceed AUD 3.35 billion at $100 USD per ounce, ensuring strong long-term profitability.

Sensitivity to Silver Prices: Boab Metals’ Sorby Hills Project is highly sensitive to silver market fluctuations. Even moderate increases in silver prices, such as reaching $50 USD, bring about substantial value growth, doubling the company’s enterprise value.

For investors looking to gain exposure to silver, Boab Metals’ Sorby Hills Project presents a compelling investment case. With its strong leverage to rising silver prices, the project offers impressive potential returns. Whether the price of silver stays moderate or continues to rise, Boab Metals is positioned to generate significant cash flows and profits, making it an attractive option for investors seeking to benefit from the growing silver market.

The current Boab Metals share price is undervalued, reflecting the company’s early-stage status. However, analysts have identified significant upside potential as the Sorby Hills project progresses toward production. With a net present value (NPV) projection significantly higher than the company’s current market cap, investors stand to benefit as more milestones are achieved, such as securing financing or offtake agreements for the silver and lead produced at Sorby Hills.

Rick Mills from Ahead of the Herd commented on goldseek “In fact, I don’t think it’s much of a stretch to say that without financed juniors, without a safe and secure supply of metals, without security of supply, without refineries and smelters, and without the technological knowledge to manufacture magnets and anodes for example the developed economies of the western world are very much at risk if supplies of these critical metals, and associated technologies, come from our competitors.”

Boab Metals' ability to operate in one of the world’s most mining-friendly regions, Western Australia, further strengthens its financial outlook. In comparison to global competitors like Rio Tinto, Boab Metals presents a unique value proposition due to its smaller size and potential for rapid growth. As demand for investing in critical minerals continues to rise, the company’s share price is likely to increase, rewarding early investors.

Inside the Sorby Hills Project: Mining Silver, Lead, and Beyond

The Sorby Hills Project is the crown jewel of Boab Metals' operations, positioning the company as a leading player in silver mining. Located in Western Australia, this project is one of the largest undeveloped silver-lead-zinc deposits in the region, offering a high-grade mining stock opportunity that investors should not overlook.

To view the 3-minute and 15-second video that provides a detailed explanation of the Sorby Hills project, released in January 2023 alongside the Definitive Feasibility Study, please click on the links below.

This is an excellent outcome for Boab Metals and paves the way for a Final Investment Decision in coming months. Boab will now finalize its offtake agreements and re-engage with financiers, including NAIF (Northern Australia Infrastructure Facility).

The following 15-minute audio update is well worth listening to: ASX Briefs Podcast Channel, Managing Director Simon Noon shares the extraordinary Keep discovery, they discuss Boab Metals' game changing strategic acquisition of Henan Yuguang's 25% stake, streamlining ownership and easing financing, and the exciting potential of Sorby Hills' silver deposits to position it as a leading silver producer in Australia.

Sorby Hills boasts more than 47 million tonnes of mineral resources, with a significant proportion of this being high-grade silver. The project is characterized by its favorable geographical location, close to key infrastructure like the Wyndham Port.

Aerial view of Wyndham Port image from Boab Metals.

This proximity reduces transportation and export costs, allowing Boab Metals to operate more efficiently than many of its peers. Additionally, Sorby Hills' lead production serves as a cost buffer, ensuring that Boab can maintain profitability even during fluctuations in silver prices.

But it’s not just silver and lead. The exploration potential for other critical minerals such as zinc and rare earths in the region makes this project even more enticing for investors. Ongoing exploration efforts, including the recent discovery of the Keep Seismic Target, suggest that Sorby Hills could evolve into a multi-decade mining operation, significantly extending its initial 10-year life span.

As the global demand for silver rises—driven by the growth of renewable energy technologies and industrial applications—Boab Metals’ Sorby Hills project is set to become a major player in the global silver supply chain.

Boab Metals: A Compelling Silver Investment Opportunity

Boab Metals, an Australian mining company, is developing the Sorby Hills Project, a high-grade lead-silver mine in Western Australia. The project’s profitability is directly tied to silver prices, offering significant potential for strong returns as silver demand continues to rise. For both experienced and novice investors, Boab Metals stands out as a compelling opportunity, particularly in a favorable silver market environment.

Why Silver Prices Matter for Boab Metals

Boab Metals' project value grows substantially as silver prices rise, making the company highly sensitive to silver market fluctuations:

At $30 USD per ounce, the project is valued at AUD 945 million, with a forecast share price of $1.93, offering stable cash flow and profitability.

At $50 USD per ounce, the value rises to AUD 1.548 billion, with a share price forecast of $3.16, attracting investors expecting silver price growth.

At $75 USD per ounce, the value increases to AUD 2.301 billion, with a share price forecast of $4.70, making it a highly profitable investment.

At $100 USD per ounce, the value peaks at AUD 3.055 billion, with a forecast share price of $6.24, providing exceptional upside for bullish silver investors.

A Profitable Future

Boab Metals is designed for efficiency, with high operating margins, particularly at elevated silver prices. If silver hits $100 USD per ounce, the company is projected to generate over AUD 3.4 billion in net cash flow by 2037, making it a highly profitable and attractive option for conservative investors seeking stability and growth-focused investors looking for significant returns.

Why Boab Metals Deserves Attention

For those looking to diversify into mining or precious metals, Boab Metals offers a unique opportunity to benefit from rising silver prices. Conservative investors can expect steady returns at lower silver prices, while growth-oriented investors could see substantial capital appreciation at higher price levels. Whether you’re new to mining stocks or a seasoned investor, Boab Metals is well-positioned to thrive as the silver market continues to grow.

The chart above illustrates the relationship between silver prices and Boab Metals' key financial metrics: Net Present Value (NPV) and forecast share price. As the price of silver increases, both the NPV and the share price of Boab Metals experience significant growth:

At $30 USD per ounce, the NPV is AUD 945 million, with a forecast share price of AUD $1.93.

At $50 USD per ounce, the NPV rises to AUD 1.548 billion, with a share price forecast of AUD $3.16.

At $75 USD per ounce, the NPV increases to AUD 2.301 billion, and the share price reaches AUD $4.70.

At $100 USD per ounce, the NPV grows further to AUD 3.055 billion, with a share price forecast of AUD $6.24.

This highlights the strong correlation between silver prices and Boab Metals' financial performance, offering potential for high returns as silver prices rise.

Here are four key performance indicators (KPIs) for Boab Metals at different silver price levels:

1. Silver Revenue: As silver prices increase from $30 USD to $100 USD per ounce, the company's revenue grows from approximately AUD 895 million to AUD 2.985 billion, highlighting the significant impact of silver prices on revenue generation.

2. Cumulative Cash Flow: Boab Metals sees a substantial rise in cumulative cash flow as silver prices climb, with values growing from AUD 1.011 billion to AUD 3.352 billion, indicating the project's long-term profitability.

3. EBITDA: At lower silver prices, Boab Metals maintains strong operating cash flow, but the EBITDA trend shows a steady decline as silver prices increase, reflecting the increasing costs and scale of operations required to generate higher revenues.

4. Net Profit After Tax: Net profit shows consistent growth, rising from AUD 769 million at $30 USD to AUD 2.574 billion at $100 USD per ounce, showcasing the high profitability of the Sorby Hills Project.

Risks and Opportunities: Navigating the Mining Sector with Boab Metals

As with any investment, it’s essential to weigh both the risks and opportunities when considering Boab Metals. While the company presents a high-upside investment opportunity, there are also risks associated with its operations.

Risks:

Commodity Price Volatility: Fluctuations in silver and lead prices can impact profitability. While Boab Metals benefits from being a low-cost producer, a significant downturn in global demand could affect margins.

Financing and Development Risks: Boab Metals is still in the development stage for Sorby Hills, and securing the necessary financing is crucial for moving forward. However, with increasing silver prices and a favorable market for investing in critical minerals, the company is well-positioned to attract investment.

Market Competition: Boab competes with larger, well-established mining companies like Rio Tinto, which have more extensive resources. However, Boab’s smaller scale allows for greater agility and potential for faster growth in the niche silver mining market.

Opportunities:

Growing Demand for Critical Minerals: As industries such as renewable energy, electronics, and electric vehicles expand, the demand for critical minerals like silver and lead is set to increase significantly. This positions Boab Metals for substantial long-term growth.

Sustainable Mining: Boab Metals' focus on sustainability and its commitment to using renewable energy, like the Ord River Hydroelectric Plant, makes it attractive to environmentally-conscious investors.

Exploration Potential: With the recent discovery of new mineralization at the Keep Seismic Target and other exploratory targets, Boab Metals has the potential to unlock additional resources, further extending the life and profitability of its projects.

In summary, while there are risks inherent in mining, Boab Metals is a calculated bet for retail investors seeking exposure to Australian mines and silver mining. With a strong management team, low-cost production model, and significant exploration upside, Boab Metals offers a well-balanced mix of risk and opportunity.

How Boab Metals Stacks Up Against Competitors in Global Mining

In the fiercely competitive mining sector, Boab Metals stands out for its strategic focus on silver and lead, as well as its ability to operate at a lower cost compared to industry giants like Rio Tinto. While larger competitors dominate with diversified portfolios spanning iron ore, coal, and other minerals, Boab Metals is laser-focused on maximizing its flagship project, Sorby Hills, a high-grade silver-lead-zinc deposit.

Boab Metals’ nimbleness allows it to respond quickly to market trends, especially in the critical minerals space, where demand for silver is rising due to its essential role in technology and renewable energy sectors. In comparison, Rio Tinto has massive operations in iron ore and uranium, but its size sometimes hinders quick project turnarounds. Boab, on the other hand, benefits from its ability to focus all resources on rapidly developing Sorby Hills.

Additionally, Boab’s smaller, highly focused exploration team continues to identify potential new mineral targets, like the Keep Seismic Target, while its competitors often struggle with the complexities of multi-commodity operations. As demand for critical minerals increases, Boab Metals is poised to benefit from a more streamlined path to production, giving it a significant advantage in terms of share price growth and operational scalability.

Compared to Major Mining Companies

Comparing Boab Metals to other mining companies helps investors understand the company’s strengths and potential relative to its peers in the industry. Below is a comparison between Boab Metals and other notable mining companies, with a focus on project scale, metals focus, growth potential, and sensitivity to commodity prices, particularly silver.

1. Boab Metals (Sorby Hills Project)

Focus: Silver and Lead

Project Location: Australia (Sorby Hills Project)

Key Strengths:

High sensitivity to silver prices, offering significant upside in a rising silver market.

Strong internal rate of return (IRR), particularly at elevated silver prices (up to 94% IRR at $100 USD silver).

Favorable jurisdiction in Australia, with regulatory stability and solid infrastructure.

Production Growth: As silver prices rise, Boab Metals is well-positioned to deliver increasing cash flow, profitability, and share price growth. Its leverage to silver offers more upside compared to diversified mining companies focused on multiple commodities.

Enterprise Value Growth: At a silver price of $100 USD per ounce, Boab Metals sees its enterprise value rise to AUD 3.05 billion, with corresponding strong shareholder returns.

2. Rio Tinto

Focus: Diversified Metals (Iron Ore, Aluminum, Copper, and Silver)

Project Location: Global (Australia, South America, Africa, North America)

Key Strengths:

Rio Tinto is one of the world’s largest and most diversified mining companies.

Its operations span multiple commodities, providing stability across market cycles.

The company has a strong global presence, benefiting from economies of scale and efficient operations across various metals, including precious metals like silver.

Sensitivity to Silver Prices: Rio Tinto's earnings are mainly influenced by its iron ore, aluminum, and copper sectors, making it less vulnerable to changes in silver prices than Boab Metals and providing limited benefit during a rise in silver market prices.

Risk Profile: Rio Tinto's worldwide operations are subject to a range of geopolitical risks. However, its diverse portfolio across various commodities and regions makes it a relatively lower-risk investment with less potential for swift growth. Conversely, Boab Metals operates solely within Australia's mining-friendly and politically stable climate, which reduces its exposure to risk.

3. Fresnillo PLC

Focus: Silver and Gold

Project Location: Primarily Mexico (the world’s largest silver producer)

Key Strengths:

Fresnillo is one of the world’s largest primary silver producers, and it benefits from economies of scale.

A diversified asset portfolio with both silver and gold mines, reducing dependence on one commodity.

Strong production capacity (50 million ounces of silver in 2020), providing a significant market share.

Sensitivity to Silver Prices: While Fresnillo benefits from rising silver prices, its gold production reduces its sensitivity to silver, making it less volatile but also providing lower upside in a silver price rally compared to Boab Metals.

Risk Profile: Higher geopolitical risk due to operations in Mexico, which may face political or regulatory challenges.

4. Silvercorp Metals

Focus: Silver, Lead, and Zinc

Project Location: China

Key Strengths:

Low production costs, making Silvercorp one of the lowest-cost silver producers in the world.

Diversification through lead and zinc production helps stabilize revenues when silver prices are volatile.

Sensitivity to Silver Prices: Silvercorp benefits from rising silver prices but has a significant portion of its revenue from base metals like lead and zinc, which limits its exposure compared to Boab Metals, which has more direct leverage to silver.

Risk Profile: Exposure to China means Silvercorp faces potential regulatory and geopolitical risks, which investors must consider.

5. Pan American Silver Corp.

Focus: Silver and Gold

Project Location: North and South America

Key Strengths:

Pan American Silver is a large, diversified silver producer with operations across multiple countries, including Argentina, Canada, and Mexico.

Economies of scale allow Pan American to deliver steady production even in times of fluctuating prices.

Sensitivity to Silver Prices: While Pan American benefits from rising silver prices, its significant gold production mitigates the company’s overall exposure to silver prices compared to Boab Metals.

Production Growth: Pan American has steady production growth, but its larger, more diversified nature means it has less explosive growth potential than Boab Metals in a silver price rally.

6. Hecla Mining Company

Focus: Silver and Gold

Project Location: USA, Canada, and Mexico

Key Strengths:

Hecla is one of the oldest and largest silver mining companies in the U.S., with well-established operations in politically stable regions.

Focused on increasing silver production capacity with strong reserves, positioning it well for a rising silver price environment.

Sensitivity to Silver Prices: Hecla is sensitive to silver price movements but less so than Boab Metals, as it is also a significant producer of gold. This diversification reduces volatility but also limits its silver-driven upside.

Risk Profile: Hecla has a stable jurisdictional footprint with operations in North America, offering lower geopolitical risks compared to peers with exposure to South America or Asia.

Key Takeaways:

Boab Metals vs. Larger Diversified Companies (Fresnillo, Pan American, Hecla): While Fresnillo, Pan American, and Hecla are large-scale producers with diversified operations, Boab Metals stands out for its pure leverage to silver prices. This gives Boab more explosive growth potential if silver prices rise, whereas the diversified companies provide more stability but with less direct upside to silver.

Boab Metals vs. Silvercorp: Boab Metals is more leveraged to silver price fluctuations than Silvercorp, which also produces significant lead and zinc. Silvercorp benefits from its low-cost production, but Boab Metals’ potential for enterprise value growth at higher silver prices is far greater.

Geopolitical and Jurisdictional Risks: Boab Metals operates in Australia, a mining-friendly and politically stable country. This gives Boab an advantage over companies like Fresnillo, Silvercorp, and Pan American, which have operations in higher-risk jurisdictions like Mexico and China.

Boab Metals offers a unique, high-leverage play on silver prices. While larger companies provide diversified exposure and stability, Boab’s potential for rapid growth in enterprise value and strong shareholder returns makes it particularly appealing for investors looking to capitalize on a bullish silver market. Its stable operating environment in Australia also reduces the geopolitical risks faced by some of its peers, adding to its attractiveness as a silver-focused investment.

Image of Ord River hydroelectric plant from Boab Metals.

Boab Metals’ Commitment to Environmental and Social Responsibility

One of the key reasons Boab Metals stands out in the mining industry is its deep commitment to environmental sustainability and social responsibility. As the world increasingly turns to renewable energy and sustainable practices, mining companies are under more scrutiny than ever to reduce their environmental impact. Boab Metals is meeting this challenge head-on.

At Sorby Hills, Boab Metals has entered into an agreement to source renewable energy from the Ord River Hydroelectric Plant, significantly reducing its carbon footprint. This use of clean energy allows Boab to operate in a more environmentally friendly manner, setting it apart from competitors still reliant on fossil fuels like coal.

Beyond environmental concerns, Boab is also committed to supporting local communities. As a part of its corporate social responsibility (CSR) initiatives, Boab Metals has sponsored local events such as the Ord Valley Muster, a cultural festival in Western Australia, showcasing its investment in community development.

Additionally, the company has been involved in educational programs aimed at improving local employment opportunities, ensuring that its projects leave a lasting positive impact.

By focusing on sustainability and building strong community ties, Boab Metals is not just delivering financial returns but also contributing to a better future for the regions in which it operates.

Future Growth: What’s Next for Boab Metals?

Boab Metals has laid a strong foundation with its development of the Sorby Hills Project, but the company has ambitious plans for further growth and exploration in the coming years. With the global push for clean energy driving demand for lead silver and zinc, Boab is in a prime position to capitalize on this trend.

One of Boab’s most exciting growth opportunities is the continued metals exploration of the Keep Seismic Target, located just a few kilometers from Sorby Hills. Recent drilling results have shown promising indications of new silver and lead deposits, which could extend the life of the project well beyond its initial 10-year mine plan.

Boab is also exploring partnerships with major players in the global mining industry, including companies based in the United States. These partnerships could provide additional capital and expertise, allowing Boab to accelerate the development of its current projects and explore new ones, particularly investing in critical minerals.

Moreover, with ongoing advancements in mining technology, Boab Metals is committed to optimizing its operations for efficiency and sustainability, further enhancing its competitiveness in the Australian silver stocks landscape. For retail investors, Boab offers an exciting opportunity to invest in a company with a clear growth strategy, supported by strong project fundamentals and a commitment to environmental responsibility.

A Step-by-Step Guide on How to Invest in Boab Metals

For retail investors looking to add Boab Metals to their portfolio, the process is straightforward and accessible from most parts of the world. As the company’s profile continues to rise in the mining Australia sector, now is an ideal time to consider purchasing shares. Here’s a simple guide to help you get started:

Choose a Brokerage Platform:

If you’re based in Australia, local brokerage services such as CommSec or ANZ can facilitate the purchase of Boab Metals (ASX: BML) shares. Investors from other regions, including the United States, can use international brokers like Interactive Brokers or eToro to access the Australian Stock Exchange (ASX).

Open and Fund Your Account:

Once you’ve selected a broker, open an account by providing necessary identification and verifying your identity. Afterward, you’ll need to fund the account by transferring money from your bank or other financial institutions.

Research and Place Your Order [Ticker: BML]

Before placing your first trade, it’s essential to conduct your own research or consult financial analysts to confirm the timing of your purchase. Once you’re ready, search for Boab Metals’ ASX ticker symbol, BML, and select the number of shares you want to purchase. You can choose to execute a market order (buy at the current price) or a limit order (set your own purchase price).

Monitor Your Investment:

After making your purchase, continue monitoring Boab Metals’ share price, company updates, and market conditions to ensure you stay informed about the stock's performance.

This step-by-step guide simplifies the process, making it easy for retail investors to gain exposure to Boab Metals and its high-grade silver mining operations.

Boab Metals and Australia’s Mining Future: What Retail Investors Should Expect

As the world moves toward a future shaped by investing in critical minerals and sustainable energy solutions, Australia’s mining sector will play a pivotal role. Boab Metals is set to be at the forefront of this shift, thanks to its strategic focus on high-demand resources like silver and lead, which are essential for the production of solar panels, batteries, and other renewable technologies.

For retail investors, Boab Metals offers exposure to both short-term gains and long-term potential as the company progresses through critical milestones, such as securing offtake agreements and advancing the Sorby Hills Project to full production. The company's agility and focus on sustainable practices position it as a key player in the Australian mining landscape, where competition is fierce but growth opportunities are substantial.

Boab Metals is also well-aligned with government priorities regarding the exploration and extraction of critical minerals, including potential future discoveries of rare earths and uranium. These minerals are increasingly valuable as nations, particularly the United States, shift away from reliance on non-renewable resources and focus on green energy solutions. With the potential for new explorations and partnerships, Boab Metals is a company poised for substantial growth in the coming years.

Image of silver bars from Boab Metals.

Why Boab Metals Is the Future of Silver Mining in Australia

In conclusion, Boab Metals presents a unique and attractive mining stock opportunity for investors looking to capitalize on the growing demand for silver, lead, and other critical minerals. The Sorby Hills Project has positioned the company as a key player in Australia's mining sector, offering low-cost production, high-grade deposits, and significant growth potential.

Boab Metals has differentiated itself from larger competitors like Rio Tinto by focusing on streamlined operations, strong community and environmental stewardship, and a clear path toward financial growth. For retail investors seeking to diversify their portfolios with exposure to silver mining and critical minerals, Boab Metals is well worth considering.

With its commitment to sustainability, exploration, and shareholder transparency, Boab Metals is not just a mining company—it's a forward-thinking leader in the future of Australian mining.

As silver continues to play a crucial role in industries ranging from electronics to renewable energy, the time to invest in Boab Metals has never been better. Don’t wait until silver prices soar—act now and position yourself to benefit from the exceptional potential returns that the Sorby Hills Project has to offer. Visit Boab Metals today and discover how you can secure your share of the future of silver mining.

“I am a shareholder in Boab Metals. Don’t take this report as investing advice and always do lots of your own research before investing any of your hard earned money, especially in the mining sector because the mining sector is very risky.

The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources.”

- Brent Connolly, Geopolitics and Precious Metals Analyst

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website: EatWanderExplore and REmotiFIRE.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Image of silver bars from Boab Metals. Bars say "FINE SILVER, 999.9, NET WT 1000 g, [7 digit number]"](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/36a33d91-5eaa-44cc-aa3e-45889a3d8bc6/boab-silver-bars.png)